NFTs were the biggest breakthrough in technology last year, its founding inextricable from the art world. Proponents point to a future where art is democratized, funds secure and royalties continuous. Detractors believe NFTs are a scam, and point to fraudulent activity and the exclusivity of highly-priced sales. A look at some of the African players in this space.

CRYPTOAPES, CRYPTOKITTIES, Beeple – according to Collins Dictionary, NFT was the word of the year for 2021. The popularity of non-fungible tokens exploded during the course of last year, with celebrities such as Eminem and Melania Trump having jumped on the bandwagon, the total market cap was estimated to be in excess of $40 billion according to data from blockchain analytics firm Chainalysis Inc.

The founding of NFTs is inextricable from the art world; almost a decade ago, the first NFT was minted. New York- based digital artist Kevin McCoy created Quantum, a pixelated, radiating octagon, was minted on the Namecoin blockchain. The artwork was sold by major arthouse Sotheby’s through their Natively Digital online auction, and fetched just over $1.4 million last year.

Competitor Christie’s sold over $150 million worth of NFT artwork during the last year, Everydays – The First 5000 Days by artist Beeple being sold for a record- breaking $69 million, positioning him amongst the “top three most valuable living artists”, said the auction house. We examine the history, possibilities, and some of the African players in the NFT space.

THE GOOD, THE BAD, AND THE INTANGIBLE

Proponents of the NFT boom in the art world point to its democratic potential; almost anyone can mint an NFT, and since this minting is performed through what is termed the smart contract – which governs transferability and ownership – these tokens have strong implications for authenticity verification and ongoing royalty payments, which has had some in the art world optimistic, even if they are not sure of the technicalities of how it all works.

“I’m clueless but excited,” says Koos Groenewald, one half of Jana + Koos, an art and design duo who participated in online art fair Latitudes’ first NFT offering late last year. “It’s like an internal combustion engine. You don’t need to understand how internal combustion works in order to benefit from it.”

Latitudes, which originally began as a successful, physical art fair aimed at promoting a platform where artists, galleries and independents could come together on an equal playing field, has faced challenges common to many in the art space

since 2019. With the emergence of the Covid-19 pandemic, the physical art world was disrupted. Like many in the industry, Latitudes made the move online.

“We launched [Latitudes] in July 2020 with around 350 artists. Now we are closer to 900 and growing nicely and quickly – we’re basically a third party marketplace with galleries, artists, curators… as long

as you have good art to sell you can bring it on to the platform,” says Roberta Coci, the co-founder who partnered with South African NFT experts and social marketplace Momint for the implementation of their first NFT-based art offering.

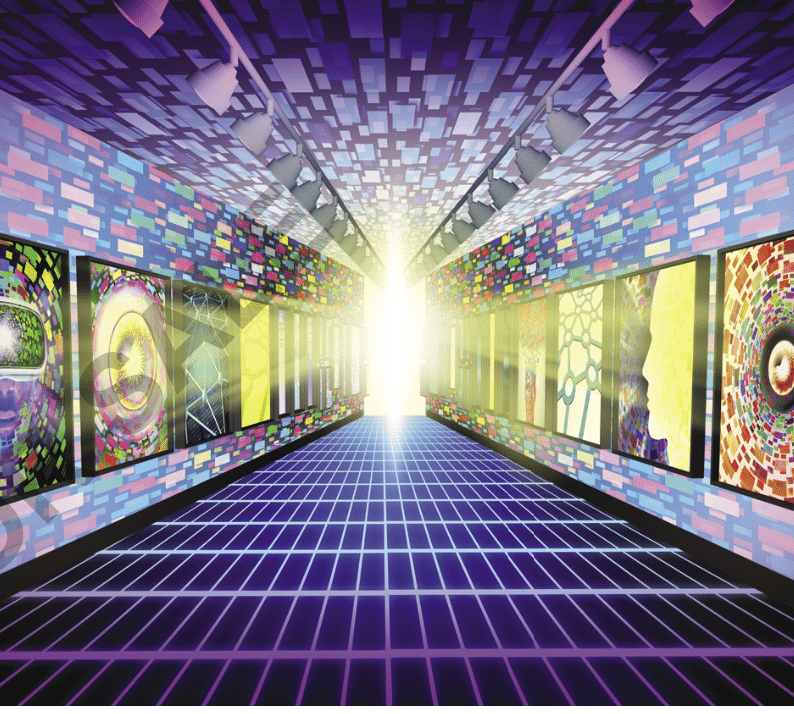

Anna Ogutogullari, founder of the newly-launched QkweQkwe.io, agrees with this optimistic outlook; a virtual marketplace where African artists can sell to a global audience, allowing the purchase of NFT- based art for the first time with the launch of their group show Multiplixation earlier this year. Unlike Latitudes, which was forced to adapt to the shifts in market during the Covid-19 pandemic, QkweQkwe is of the belief that NFTs provide a unique opportunity to decentralize control of the contemporary art world, but both platforms agree on the benefits to artists themselves.

“If you look at the contemporary African art market, you’re looking at about $15 billion,” says Ogutogullari. “It’s very interesting because there’s a lot of interest into the NFTs and digital space, but there’s not at the moment a lot of African players… If you look at what’s happened in Sotheby’s, in the last auction where the majority of the work was actually African, and that is the type of change that we want to see in the future African art market, where Africans are supporting Africans.”

Artists from QkweQkwe’s stable are similarly excited about the possibilities of both African representation, and continued royalties, but acknowledge the risks with entering such a new field with their work.

“I don’t have too many high expectations,” says Zamani Ngubane, a participating artist whose work focuses on local portraiture. “That’s how I always approach new ventures – but I’m here to learn and open my mind to the world of NFTs.”

However, it’s worth noting that there are many proponent skeptics of the value of NFTs to the art world, and this criticism rests on concerns regarding historical and current issues of money laundering through art, as well as the abundance of scams already being run through the NFT space.

Indeed, the NFT art world is evidently susceptible to many of the same perils that proponents claim it should mitigate; on many of the most popular NFT marketplaces, hundreds of artists have suffered from identity fraud, as well as simply having NFTs sold linking to their work without permission, with Twitter user @NFTtheft cataloguing many such incidents.

“What the hell is this? So, founder of this site is offering me on some sort of NFT deal. He sent me this SS. He already made an account and posted my artworks there. WT*? I didn’t give any permission at all. He made an account with my name without even me knowing it,” tweeted Indonesian artist Yuditya Afandi. A user had created an account on the marketplace NFT Restake under their name, and listed Afandi’s artwork for sale.

Part of the prevalence of fraudulent activity can be ascribed to the emergence of a new medium on relatively nascent technology – with many not understanding how NFT-linked artwork functions, there will be more exploitation until people become more familiar with the platform. This only accounts for part of the problem though – the other two challenges are inherent to both the art world and aspects of the technology that NFTs are based on.

TO THE ARTIST, THE ART

Describing the art world as an “ideal playground for money laundering”, a 2020 report commissioned by the US Senate identified the art market as “the largest legal, unregulated market in the United States”, and are not required (in the US) to maintain anti-money- laundering financing controls.

High-ticket fine art items are often handled with extreme privacy, with pricing often being subjective or easily manipulated. Drug cartels and terrorist organizations count themselves amongst the simply wealthy that have had money laundering transactions through art purchases extensively documented in the media.

In some senses, NFT-tied artworks are able to offer the same advantages to fraudsters and money launderers, with added benefits; transactions occur primarily via cryptocurrency rather than fiat, which offers several novel ways to remain anonymous and obfuscate fund origins and destinations, as well as a lack of common understanding, allowing for grifters to run rampant.

When Christie’s announced their landmark auction of the NFT for Beeple’s Everydays – The First 5000 Days, Google Trends data indicated that searches for the term “NFT” multiplied 28 times in the three weeks leading up to the auction itself.

The media too was in a frenzy, fascinated by the new platform of digital art and the possibilities it offered.

The buyer of Everydays – The First 5000 Days, an initially anonymous bidder termed ‘MetaKovan’, later unmasked as cryptocurrency enthusiast Vignesh Sundaresan, paints himself as a patron of new technologies, an angel investor and proponent of free information. Sundaresan manages the Metapurse fund, which had previously purchased works of Beeple’s, bundled them together, and then sold fractional ownership of these works in the form of a proprietary crypto token – the B20 token, of which they retained a majority stake.

Interestingly, 2% of the tokens were given to Beeple himself.

Speculative interest on the token due to hype around the Christie’s sale drove the value of the B20 token up to 13x its price over a period of less than a month into the run-up of the Everydays – The First 5000 Days. Journalist Amy Castor provided an excellent analysis of the behavior behind this particular sale.

However, this is not a view held by all within the NFT-based art world. Many in the art-related NFT space acknowledge the challenges present both in the art industry historically, and in the early-adopter space that is NFT- based art.

QkweQkwe is combating this possibility through both strict legal agreements with their artists, as well as a strongly progressive approach to technology; namely, that unlike many platforms where an NFT simply serves as a record of ownership of the work, the platform ensures that the NFT is the artwork in question, what is termed an on-chain NFT artwork, a rarity in the space.

IF NFTS ARE LIKE AN INTERNAL COMBUSTION ENGINE, SPECULATION WITHOUT UNDERSTANDING IS LIKE DRIVING WITHOUT BRAKES

In the simplest terms, an NFT is a representation of something unique – and in the case of NFT- linked digital artworks, the NFT is a way to indicate ownership, sale, proof of transaction history, all of which can be independently verified, but it isn’t the artwork itself.

Whether the artwork is the animated cartoon cat flying through space leaving a rainbow trail, or an ape in pastel colors with a gold chain and a peak cap – most NFT art exists off the blockchain, simply termed “off chain”.

For example, if you purchase an NFT, the proof of your ownership is largely secure from corruption and permanent, unless you decide to sell the NFT.

Here’s a metaphor.

You buy a painting which is kept in an art gallery, and the gallery updates its unchangeable ownership book listing your name as the owner – that’s the smart contract part of the NFT. Anyone can walk into the gallery and take a photograph of the painting, but it’s ownership is irrefutably yours, and anyone can check the gallery’s ledger to prove this.

What happens when the gallery burns down?

Off-chain NFT artworks are not stored on the blockchain, but usually on centralized servers with the company listing them for sale (such as the servers of the NFT marketplace OpenSea), or a slightly more secure decentralized protocol called InterPlanetary File System (IPFS), which functions similarly to torrent files. The NFT points to an address on either the company servers or IPFS which contains the artwork itself, the actual file, and if the company goes out of business you may find that your NFT points you to owning nothing at all.

“So @CheckMyNFT has been tracking NFTs created on Nifty, and apparently most of them are already broken,” tweeted @JontyWareing, referencing the fact that many artworks hosted on the Nifty marketplace have disappeared due to failures in their hosting.

There are attempts to neutralize these risks in NFT artworks, with on-chain solutions in the works. Innovative developers have also provided opensource checks which allow you to view how your digital assets are stored. However, it doesn’t seem that most artists or marketplaces are concerned with the permanence of the works purchased, or how they are stored.

DEMOCRATIZATION? NOT NECESSARILY

Proponents of NFTs point to the technology democratizing the production and ownership of art, with the promise of continuous royalties and the ability to bypass the gallery ecosystem being major selling points to many digital artists moving into the space. There is also the implicit promise of securing lucrative sales, and the popular coverage of high-profile and highly-priced works has encouraged this.

However, the data bears a different picture – recent research published in Nature indicates that the NFT space mirrors the traditional art world, with a mere 10% of buyers and sellers of NFTs accounting for 90% of transactions and value, indicating that large marketplaces and brokers such as OpenSea are playing a role similar to gallerists in the non-crypto world.

“[We] made a breakthrough in new sales formats and categories, NFTs in particular,” said Christie’s CEO Guillaume Cerutti in a press statement, of the auction house’s most lucrative year in the last half- decade.

Sotheby’s too recorded similar successes – it’s notable that these major houses were both early adopters of NFTs and hybrid art, and that they recorded such high sales, which seem to contradict the narrative that NFTs are opening the art world up to more everyday artists.

NFTs AS A HOT TOPIC: GOOD FOR THE PLANET?

Some digital artists have voiced detraction for NFTs or boycotted the medium entirely due to concerns about the effect on the earth’s climate. While NFTs are still in their infancy, and not responsible for the majority of transactions on the Ethereum network – where most transactions take place – the cryptocurrency itself relies on what is termed ‘proof of work’, similar to Bitcoin, where millions of computers solve complex mathematical problems in order to keep transactions secure.

Researchers and developers of Ethereum itself estimate the annual electricity consumption of the platform to be anywhere between 45TWh and 75TWh per year, comparable to the usage of the entire country of New Zealand.

Some galleries and artists participating in NFT sales have promised to spend a percentage of their profits investing in green technologies, attempting to offset the impact of their energy usage.

QkweQkwe are in support of Ethereum moving to a ‘proof of stake’ model, which would be less energy-intensive, as well as setting aside profits to CSR initiatives to counter the climate effects caused by their NFTs.

However, not all consumers have supported the offset model, with some believing that this is but a panacea to a broader problem inherent to crypto-based platforms.

“ArtStation going into NFT and saying ‘but don’t worry! We’ll pay for carbon offsets’ is the equivalent of setting a house on fire. then placing a single potted plant on the burned property as “compensation”,” tweeted user BleachedRainbows, of an NFT sale event that was ultimately shut down due to concerns around its environmental impact.

The Ethereum network – and by extensions NFTs – have been planning to move to a ‘proof of stake’ model, whereby users would put up their coins as collateral instead of having to perform the electricity intensive ‘proof of work’, which would massively reduce the energy usage of the network.

However, this has been in the pipeline for some years without change, and many remain doubtful that it will be implemented. As the world becomes more aware of the peril of climate change, more and

more digital artists are hesitant to work within a medium that might contribute to the damage of the planet.

Attitudes in the South African market are broadly positive – other than Latitudes and QkweQkwe.

Cape Town-based art gallery World Art also presented an NFT sale last year.

“This is a ground-breaking development in the art world. I am particularly thrilled that this mechanism guarantees artists royalties when their artworks are resold,” said gallery owner Charl Bezuidenhout. Museums, and even rhino-conservation efforts are moving into the space, with a tokenized pen-gun owned by South African anti-apartheid activist OR Tambo and a digital rhino horn going on sale.

METAVERSE – COLLINS DICTIONARY WORD OF 2022?

Facebook’s media rebrand to Meta late last year was no accident. The tech giant sees the metaverse as the future of the internet, and is aiming to lead the way in planting a flag in what Mark Zuckerberg believes will be greater immersion into a fully virtual world.

Meta is pumping millions of dollars into infrastructure and applications for a time where many people will be spending time fully immersed in a virtual world.

“The ‘metaverse’ is a set of virtual spaces where you can create and explore with other people who aren’t in the same physical space as you,” is how Facebook defines this space.

While there is no exact consensus or definition as to what the metaverse will be, multitudes of tech conglomerates are exploring what this vision will look like, and the question arises – how will you own digital assets within the metaverse?

With none other than JP Morgan estimating that the metaverse represents a $1 trillion market, and participating in the launch of its own virtual Onyx Lounge in virtual reality 3D world Decentraland, alongside other major companies such as Nike, Samsung and Walmart.

Much of the reason why the public connection to the idea of

the metaverse is so tenuous is just how early the adoption still is – normative, mainstream experience and acceptance is likely still years away, but pioneers are already staking their ground, with over $100 million being spent in a single week on digital real estate late last year.

And how is it that you own this digital land in the metaverse? Why, through NFTs.

At this early stage however, the possibilities are still quite limitless, with artwork, real-estate and digital products for one’s online avatars being first in line for application.

However, the possibilities at this stage are relatively endless; from location-based NFTs allowing access to real world spaces or dining experiences, DNA testing, real-world clothing and more.

Whatever the future of NFTs holds, it’s certain that the use cases are still at an early stage, and the art-world is trailblazing the adoption of a technology sure to change the face of digital interaction for decades to come.