The NFT craze has minted its first billionaires.

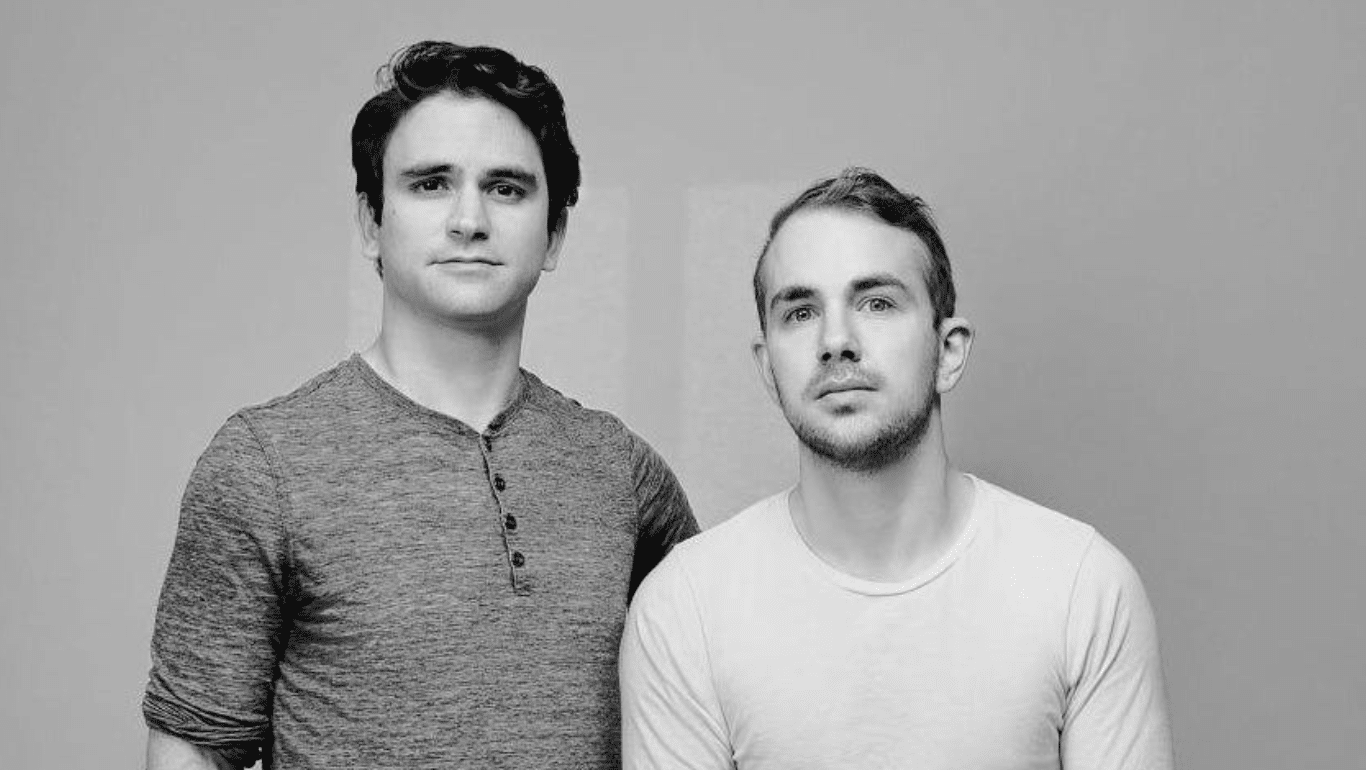

The founders of buzzy blockchain startup OpenSea have joined the three-comma club following a fresh funding round announced Tuesday that values the company at $13.3 billion—up from $1.5 billion just six months ago. With estimated 18.5% stakes in OpenSea, cofounders Devin Finzer and Alex Atallah are each worth about $2.2 billion, Forbes estimates. (Forbes applies a discount to the value of privately-held companies due to limited liquidity. An OpenSea representative declined to comment.)

Founded four years ago, the New York City-based startup was an early player in the NFT market that took off in early 2021. Shorthand for “nonfungible tokens,” NFTs are computer files used to track ownership of unique digital assets like art, music and even virtual sports cards on a ledger known as a blockchain. OpenSea bills itself as a peer-to-peer platform on which users can create, buy and sell all sorts of NFTs—in exchange for a 2.5% cut of each sale.

OpenSea has grown rapidly over the past year. In March 2020, the five-person outfit counted roughly 4,000 active users doing $1.1 million in monthly transactions, for about $28,000 in monthly revenue. Its luck changed in February 2021, when platforms like the Winklevoss twins’ Nifty Gateway generated buzz by auctioning off high-end digital art. By July, OpenSea had closed a $100 million funding round led by venture capital firm Andreessen Horowitz and recorded about $350 million worth of transactions that month. The next month, transactions hit $3.4 billion—a staggering ten-fold increase that earned the company $85 million in revenue from commissions.

The NFT market cooled off slightly in the months that followed, before heating up again in December. OpenSea processed more than $3.3 billion worth of sales last month, generating about $82.5 million in revenue for itself. Today, the company employs more than 70 people.

Finzer and Atallah, each around 30 years old, have familiar resumes for young tech billionaires. CEO Finzer grew up in the Bay Area, studied at Brown University and took a job as a software engineer at Pinterest. In 2015, he cofounded his first startup, a search engine called Claimdog, before selling it to Credit Karma a year later for an undisclosed sum. Colorado-born Chief Technology Officer Atallah proved to be a spreadsheet whiz from a young age. While he was a student at Stanford, he worked at Palantir, according to his LinkedIn profile, and after graduating worked at Silicon Valley startups Zugata and Whatsgoodly.

In January 2018, the duo teamed up for the Y Combinator startup accelerator with an idea for paying users crypto to share their Wi-Fi hotspots. But CryptoKitties—the cartoonish virtual cats that were among the earliest examples of NFTs—captured their imagination. Finzer and Atallah quickly pivoted to launch OpenSea and relocated to New York.

Since its start, OpenSea has raised more than $420 million from investors, according to data from PitchBook. The $300 million series C haul announced Tuesday was led by venture capital firms Paradigm and Coatue. OpenSea says it plans to increase its headcount, with a focus on its “trust and safety” teams, and invest in making its products more accessible to a wider audience.

OpenSea faces heightened competition, including from crypto giant Coinbase, which in October announced plans to launch its own NFT exchange. Critics have also called out the potential for fraud and scams in the NFT world. In September, Finzer requested the resignation of OpenSea’s head of product after he was discovered to be buying NFTs shortly before they went live on the marketplace. And, just last week, a New York art gallery reportedly claimed that $2.2 million worth of NFTs had been stolen from him and listed on OpenSea.

If the company can navigate the choppy waters, even greater riches could be on its horizon. Some $23 billion worth of NFTs exchanged (virtual) hands in 2021, according to data tracked by DappRadar–and the market is just getting started.

“Our vision is to be the destination for these new open digital economies to thrive,” Finzer said in an emailed statement.

By Eliza Haverstock, Forbes Staff