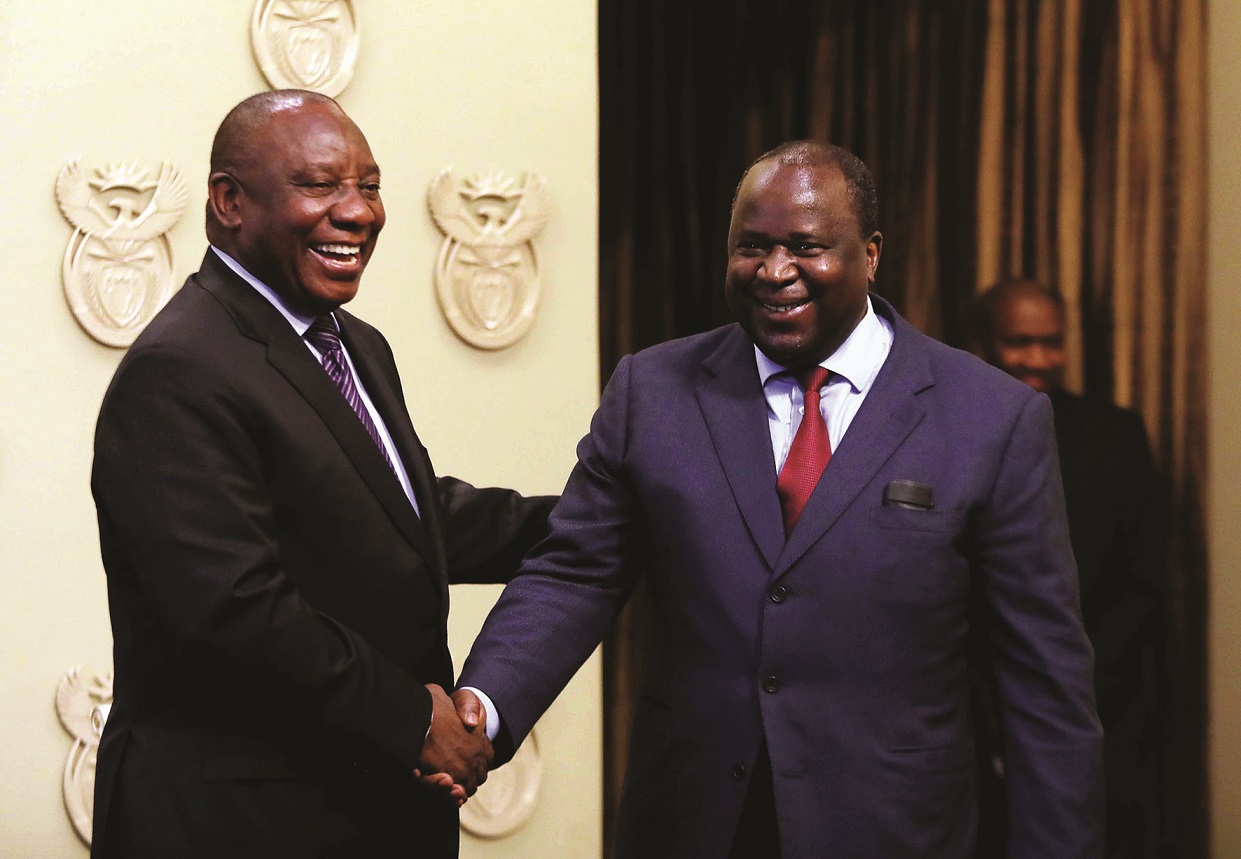

Tito Mboweni inherits Africa’s recession-hit country as president Cyril Ramaphosa chases growth.

If the performance of South Africa’s currency in the week since Tito Mboweni was picked as finance minister is any good, Africa’s only economy in official recession might be on to a good thing.

The rand, Africa’s most freely-traded currency, gained more than 5% against the dollar in the week since the former central bank governor replaced Nhlanhla Nene who quit after lying about his dealings with a business family, the Guptas, accused of bribing government officials including former President Jacob Zuma.

The former labor minister brings a no-nonsense approach analysts say will be needed to take Africa’s second-largest economy out of a largely self-inflicted second recession in less than a decade amid graft allegations. He will need to rein in government spending, six months before elections that may drop the ruling African National Congress’ (ANC) support below half for the first time since the dawn of democracy in 1994.

Loading...

“Fiercely independent and often regarded as a bit of a maverick, Mr Mboweni is nevertheless likely to emerge as one of Mr Ramaphosa’s more inspired decisions,’’ says Gary van Staden, analyst at Cape Town-based NKC Research.

“He is certainly among the more highly-regarded choices the president could have made and we expect him to add momentum to the decisions of the job summit and economic stimulus package.’’

Mboweni served four years as labor minister in former President Nelson Mandela’s government where he developed the first post-apartheid labor law. At the South African Reserve Bank, where he was the country’s first black governor, Mboweni spent a decade, and built a reputation as a conservative banker and defender of the country’s newly-adopted inflation-targeting regime.

His major achievement was building the country’s foreign exchange reserves from less than $10 billion to $40 billion when he left in 2009 after two terms deemed by most as successful.

READ MORE: One on One With Naledi Pandor SA Minister of Higher Education

“The economy is now in a safe pair of hands. It is someone senior both in the ANC and in the government as he served as a minister of labor previously. What is also important is we have ratings agencies watching us and this will bode well for them,’’ says independent economist Mike Schussler.

Mboweni takes charge of an economy that was in recession in the first six months of the year, hobbled by nine years of poor management under Zuma which left business confidence shattered. With the economy barely growing during the period, the country lost its investment grade rating from Standard & Poor’s (S&P) and Fitch Ratings.

Only Moody’s maintained its rating above junk and the company deferred a decision after Mboweni’s appointment, fanning hopes it will give him time to mend the country’s finances and present a credible growth plan.

But economists say it might be too late for a country that needs to cut spending while chasing economic growth.

“I am afraid we have overplayed our hand on the numbers,’’ says Dawie Roodt, an economist at Efficient Group in Johannesburg.

“The fiscal numbers are unsustainable and the debt numbers in particular are terrible. From a numbers point of view, I am afraid this is a downgrade.’’

The new minister has a full problem tray as he comes in: unemployment is sitting at 27.2% as companies grapple with soaring costs inflated by a weak rand, falling government revenues in a country where 17 million people depend on government grants, and weak business confidence.

But his appointment may provide the turning point the country desperately requires, according to Van Staden.

“The former Reserve Bank governor can be a difficult personality, but his skillset and deep understanding of financial markets are likely to see him embrace a market-orientated policy framework with a no-nonsense attitude and dedication to economic growth and social development. We expect the appointment to have a positive impact on the credibility of the Ramaphosa administration.’’

It is credibility Ramaphosa has been building and one he will need quickly, according to Ravi Bhatia, a director at S&P which rates the country’s debt junk with a stable outlook. Its next rating decision is scheduled to be announced on November 23.

“He will have to get up to speed quite quickly,’’ Bhatia said pointing to the country’s Medium Term Budget Policy statement released in October. “He will have to push through measures that will deliver growth. We want to see growth being delivered and the fiscal line being controlled.’’

– Godfrey Mutizwa

Loading...