From November 7-9, Africa Inc. will convene in South Africa’s Gauteng Province, the continent’s seventh largest economy, for the inaugural Africa Investment Forum (AIF).

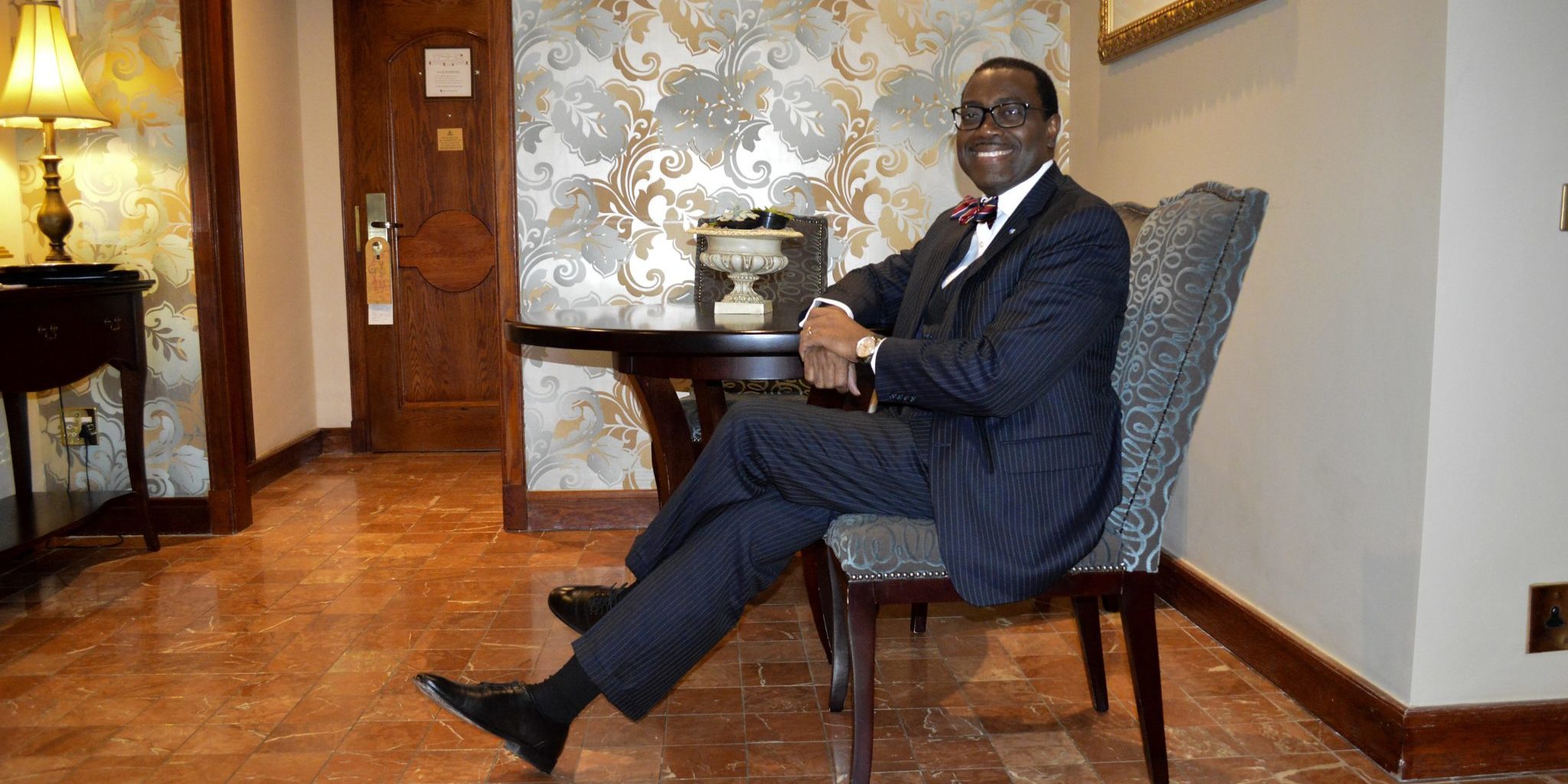

An initiative of the African Development Bank (AfDB), it was announced in May in Johannesburg by AfDB President Akinwumi Adesina with Gauteng premier David Makhura.

“It will be the continent’s first-ever investment market place,” said Adesina, formerly Nigeria’s minister of agriculture.

“South Africa is open for business again, and as Gauteng, we are ready to host the forum on behalf of not only South Africa, but for Africa,” said Makhura, calling the forum “the Davos of Africa”.

A platform to close the investment gap, Adesina called it a game-changing initiative.

READ MORE: The Investment Hotspot

“It cannot be business as usual, it must be business unusual,” he said.

With Africa’s population set to be two billion by 2050, its development needs will require an estimated $600-$700 billion per annum. So accelerated development will be the forum’s focus.

“The forum will be 100% transactional. There will be no political speeches. The only thing allowed will be transactions, transactions and transactions,” said Adesina. In attendance in November will also be African heads of state who will be present as the CEOs of their countries.

In a sit-down interview with FORBES AFRICA, the AfDB president shared more about new investments, and the bread baskets and Silicon Valleys of Africa:

How will AIF take Afro-optimism and the African growth story further?

African economies have been growing relatively well in a very difficult global environment. Despite the global economic downturn, in 2016, they grew at roughly 2.2%; in 2017, they grew at 3.6%. In 2018, they are projected to grow at 4.1%. And that’s still above the global average.

So Africa’s head is above the water. But it’s more than about keeping your head above the water that matters, it is about how fast you can swim. I think Africa needs to swim fast and needs a lot of oxygen to do that. And that means a lot of firepower in terms of capital to close the infrastructure gap. To be able to drive millions of people out of poverty, Africa should be growing at double digits.

To be able to do that we have to deal with the problem of lack of electricity, make sure there is a lot more investment to allow trade to happen. Africa could contribute a lot more be it is rail, ports, national highways or aviation. It has to change lives on the ground and quiet honestly when people ask if I am an Afro-optimist, I am a very proud African. Africa is a beautiful place and has tremendous potential so we shouldn’t always just talk about the potential because nobody eats potential. We have to unlock that potential. So that is what the Africa Investment Forum is all about. Be it oil, gas, minerals or agricultural commodities, Africa is awash with rich resources.

The question is how to turn them into real dividends with significant amounts of revenue that allows a better quality of life for the people. For that, you need to deal with the infrastructure deficit. We used to say it is about $15 billion. But that has changed. The AfDB recently released the African Economic Outlook report and the deficit is anywhere between $67 billion to $107 billion every year, so which means we must do a faster job pulling capital together because the rest of the world is not waiting.

How long will it take to close that gap?

I think within the next decade. But it’s going to take a lot of work…

What about the youth dividend; what are the future industries?

Africa is at the very top in fintech and mobile money… but as we look at new types of industries, we have to look at them in the context of the fourth industrial revolution… I get excited when I see the youth in Africa well-educated, they are all on social media, know how to use apps, which means they already have a leg up. So the key is how to re-tool them to operate in that kind of a new economy. The AfDB is doing that in three ways already. First is we signed up a joint program with Google and Microsoft to help develop young talented Africans in computer technology. We as a bank are already investing in technology parks in Cape Verde, Angola, Kenya, Senegal, Rwanda. These are technology parks where you can have the ICT industries emerge; almost like trying to create the Silicon Valleys of Africa.

When it comes to the new economy, you have to start early. We have a program trying to create 250 coding centers in Africa where you get people with computational knowledge to do coding services that can help in this new world we are moving towards. We are also investing in universities for science and technology across Africa to create this new scientific human capital…We need to give African youth the skills they need for the jobs of the future, not for the jobs of yesterday.

What then are the new wealth generators?

If you look at where the money is going in Africa, it’s not actually going into oil, gas and natural resources. Most of the foreign direct investment (FDI) is going into the service industry, at least 64%, and also the financial services sector; maybe about 27% goes into the manufacturing sector. So these are the big sectors where you see a lot of FDI. But there are two sectors very important for me.

One is ICT, because this is going to be the driver of the economy. It’s very important for countries to invest heavily in the ICT industry to give their countries the platforms they need in the knowledge economy.

The second is the food and agriculture industry. Africa has a lot of oil and gas, but nobody drinks oil, nobody smokes the gas. Food is the future. The size of the food and agriculture industry in Africa is going to be $1 trillion by 2030 in Africa. This is where the wealth is supposed to come from. Unfortunately, in Africa, we always walk past gold. Just imagine you are seeing gold, and you see it as dirt and don’t recognize it. That’s the power agriculture has… The food business is the biggest business. Agriculture is not a development sector, it’s not a social sector, it’s a wealth-creating sector. Agriculture is a business and Africa needs to fully unlock that potential. If you look at the amount of arable land left to feed nine billion people in the world by 2050, it is not in Europe, Latin America, Asia, or the US, it’s in Africa – 65% is right here. What Africa does with agriculture will determine the future of food for the world.

How will Africa’s billionaires and capitalists help achieve these goals?

If you look at the high-networth-individuals in Africa, the majority of them make their money on this continent, and that’s already a strong signal. Aliko Dangote makes his money in Africa.

So we are going to get them involved on the Africa Investment Forum because it is trying to send a message to the world that we have African businesses that are viable businesses making money and doing well on the continent; so putting capital to help them expand can help them become global multi-national companies…

And investing in African entrepreneurs?

The issue for entrepreneurs is finding them, nurturing them and then putting the financial backing behind them to thrive. Africa has a lot of young people. Every day, I wake up I read about a young person doing so well. So the best investment that Africa can make is to put its capital at risk on behalf of its young people. Because when you see a young person walk into a financial institution, all you see is risk, risk, risk. We have to change that and try and see creativity, innovation and entrepreneurship. So that way we can put your money at risk to make them more creative, more innovative and unleash their entrepreneurship capacity. That is why at AfDB, we have a program helping to invest in the early-stage businesses of young people. Mark Zuckerberg and Bill Gates didn’t just get there, somebody had to believe in them.

We have a program set up with the European Union called Boost Africa to invest in young people. The other thing we are doing is helping unleash entrepreneurship in the food and agriculture industry. The bank has a program targeted at getting young graduates, medical doctors, engineers… who are all going to agriculture as a business. Last year, AfDB invested over $860 million in that program for about eight countries. Going forward, we expect to invest $1.5 billion dollars every year in that program for the next 10 years.

I really think unless we change the mindset, the labor composition of the agricultural sector and create a new dynamic group of entrepreneurs in the food industry, we only will have old people left. Every university in Africa has to make entrepreneurship compulsory.

– By Karen Mwendera and Methil Renuka