What kind of silver spoon was little Archie Harrison Mountbatten-Windsorborn with in his mouth? Probably a gold one. After all, his great-grandmother lives like a queen.

Only Elizabeth II can call several palaces home, don Cartier tiaras, own rare paintings, collect Thoroughbreds, and match endless colorful hats with a rainbow of outfits without being a billionaire. Her Majesty, who has worn the crown since 1953, lives the life of the ultrarich but is nowhere close to being one of the wealthiest in the world—or even her United Kingdom. The Queen’s nine-figure net worth—estimated at $500 million—lands her way below the 2,153 billionaires on Forbes’list this year. And yet she enjoys a lifestyle any of them would surely envy.

The 93-year-old directly owns some assets like Balmoral Castle in Scotland and Sandringham Estate in Norfolk, but many of her most valuable assets like Buckingham Palace are owned by a body called the Crown Estate.

If she were to possess the Crown Estate—which includes a myriad of properties in the U.K. and is owned by neither the government nor the royal family—as well as the Duchy of Lancaster (a private trust governed by the same ownership rules), Forbes estimates that the Queen would be the richest person in the U.K. (and the third-wealthiest woman in the world) with a net worth of more than $25 billion. And even that number doesn’t take into account the value of the Royal Collection Trust, which, with its Fabergé eggsand Rembrandt paintings, could be worth in excess of a billion dollars.

And she does earn a living. The Queen derives an annual income from the properties held by the $18 billion Crown Estate and the Duchy of Lancaster, a real estate trust dating back to 1265, that paid her $27 million (pretax) in fiscal year 2018 for personal expenses. The Sovereign Grant, which equals 25% of the income from the Crown Estate, goes toward the Queen’s official expenses, which include payroll, travel, housekeeping, maintenance costs and even IT expenses. (She is on Instagram, after all.) And none of that includes any winnings she earns betting on her beloved racehorses.

Naturally, Queen Elizabeth’s eldest son, Prince Charles, is not as wealthy as his mother—yet. The 70-year-old Prince of Wales derives his annual income from the Duchy of Cornwall, which manages a real estate trust that largely consists of 131,000 acres and more than $450 million in commercial assets within the U.K. The proceeds from Cornwall cover not only the annual expenses of Prince Charles but also of his two sons and their families: Prince William, the Duchess of Cambridge and their three children; and Prince Harry, his wife, Meghan Markle, and baby Archie. Though considerably more modern and down-to-earth than their grandmother, the young Windsors live like, well, royalty. In 2018, the families of William and Harry had $6.1 million in personal expenses, although the royals’ official financial statements do not detail what those expenses were.

Despite the endless fascination with the royals around the world, there is a faction in the U.K. who believe the family is a burden on taxpayers. That’s not necessarily the case, however, according to Richard Haigh, the managing director of Brand Finance, a U.K.-based valuation company. “Last year, we valued the boost to the U.K. economy from Harry and Meghan’s royal wedding in Windsor at almost $1.5 billion,” Haigh told Forbes. And in its latest report on the monarchy from 2017, Brand Finance estimated that the family is responsible for more than $700 million in annual tourism.

In other words—everyone is royally flush.

With additional reporting by Hayley C. Cuccinello, Ariel Shapiro and Kristin Tablang.

The Royal Family by the Numbers

REAL ESTATE

$18.7 billion: The real estate owned in Great Britain by the Crown Estate and its Scottish counterpart. The Queen technically owns this portfolio of commercial and industrial properties, but she cannot sell any of it.

$4.7 billion: According to Lenka Duskova of the Czech real estate agency Luxent, the value of Buckingham Palace, the 775-room residence of the United Kingdom’s sovereigns since 1837, would be worth a little bit more than Richard Branson. (Not that the royal family is looking to move.)

$1.3 billion: The net assets of the Duchy of Cornwall, which spans 131,000 acres. Its portfolio include the Isles of Scilly, residential and commercial properties in London and Llwynywermod, the Welsh home of Prince Charles and Camilla Parker-Bowles, the Duchess of Cornwall.

$740 million: The net assets of the Duchy of Lancaster, which includes some 46,000 acres of land in England and Wales acquired by the Duchy over seven centuries, London’s Savoy Chapel (built in 1512), as well as limestone and sandstone quarries and a gypsum mine.

$600 million: The value of Kensington Palace, the childhood home of Queen Victoria and the residence of young royals for more than three centuries, according to Luxent. The Duke and Duchess of Cambridge and their three children live in Kensington Palace 1A, a 20-room, four-story “apartment.”

GIVING BACK

$428.2 million: The profit turned by the Crown Estate in 2018, which was deposited into Britain’s Treasury rather than the Queen’s many purses.

$145.6 million: The combined assets held by Prince Charles’ charities, which support economic, environmental and social causes in Britain and around the globe.

$46.7 million: The amount spent on charitable activities in 2018 by Prince Charles’ philanthropic organizations.

$31.5 million: The value of Princess Diana’s estate at the time of her death, according to her will. The bulk of that sum went to her sons, Princes William and Harry, each of whom inherited a share on his 25th birthday. The remainder was split between her 17 godchildren and her former butler Paul Burrell, who received£50,000 (about $81,000).

1,762: The number of offshore wind turbines that are part of the Crown Estate.

LIFESTYLE

200 billion: The number of times the image of the Queen on U.K. postage stamps has been reproduced. The design has not changed since 1967 and is believed to be the most reproduced work of art in history.

$17,627,021: Amount that the jewelry and Fabergé items from the collection of Princess Margaret brought in at Christie’s in 2006. The exquisite pieces included the Poltimore Tiara—made in 1870 by Garrard for Lady Poltimore, the wife of the second Baron Poltimore and Queen Victoria’s treasurer—which sold for $1.7 million.

$2,423,050: The amount an unused Mauritius “Post Office” twopence from 1847 (No. 13)—which mirrors the piece widely regarded as the most valuable stamp in the Royal Philatelic Collection (No. 14)—sold for in 1993. The prized collection—which has never been appraised—also boasts one of two 1854 Bermuda “Perot” stamps still in existence, the other having last sold for $340,000 in 1996.

$2.2 million: Meghan Markle’s net worth based on her salary from Suits. The Duchess of Sussex starred as Rachel Zane on the legal drama for seven seasons and earned an estimated average of $57,500 per episode.

$1,039,758: The auction price of the 1955 Rolls-Royce Phantom IV belonging to Queen Elizabeth sold at Bonhams’ Goodwood Revival Sale in September 2018. The previous year, a bespoke 2001 Daimler Super V-8 commissioned by the Queen fetched $55,575—and in November 2016, Princess Diana’s beloved 1994 Audi Cabriolet sold for $59,500 at Silverstone Auctions’ NEC Classic Motor Show sale.

$583,000: The total earnings of Queen Elizabeth’s champion horses in the past year, according to the British Horseracing Authority. The Queen’s most valuable horse of all time, Estimate—an Irish-bred, British-trained Thoroughbred that won the Queen’s Vase at Royal Ascot in 2012 and the Ascot Gold Cup the following year—collected more than $487,000 in prize money before retiring to the Royal Stud at Sandringham in 2014.

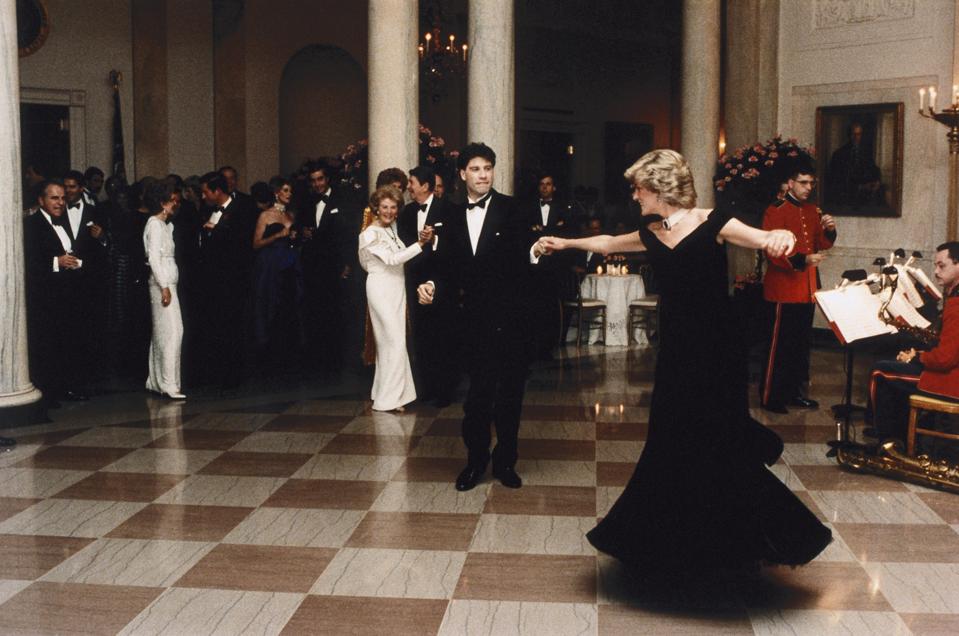

$222,500: The amount a midnight-blue velvet Victor Edelstein evening gown Princess Diana wore to a 1985 state dinner at the White House hosted by President Reagan—where she famously danced with John Travolta—sold for at auction in 1997.

$25,277: The cost of Prince George’s tuition at Thomas’ Battersea for the 2019—2020 school year, inclusive of books and registration fees.

23,578: The number of gemstones showcased in the Crown Jewels, which are housed in the Tower of London. The Sovereign’s Sceptre with Cross has been used at every coronation since Charles II’s in 1661 and boasts the Cullinan I diamond, the largest top-quality cut white diamond in the world, weighing 530.2 carats.

$7,500: How much a slice of cake from the wedding of Prince William and Kate Middleton sold for at Julien’s Auctions in December 2014—four months after a slice of the five-tier fruitcake from Prince Charles and Lady Diana Spencer’s wedding sold for $1,375. The year before, a piece of Queen Elizabeth and Prince Philip’s 9-foot-tall, 500-pound cake sold for a relatively low $896.

$3,900: The final price of a felt-and-velvet doll from 1935 once belonging to Princess Elizabeth, which sold in December 2018. The year prior, a pair of Deans Rag Book Co. Mickey and Minnie Mouse toys—given to Princess Elizabeth and Princess Margaret by their nanny Clara Allah Knight—fetched $1,164.

1,306: The number of corgis registered in the U.K. in 1944, when Princess Elizabeth received one for her 18th birthday. Corgi registration jumped 56% that year and would continue to increase until 1960. The Queen’s influence over the corgi market is so great that when her last pup died in 2018, the Kennel Club temporarily placed the short-legged breed on its “At Risk” list.

800: The number of royal warrant holders, which range from luxury brands such as Burberry to family-run saddle maker Abbey England. The royal warrants recognize those who supply goods or services to the royal family. Brand Finance estimates a royal warrant can contribute as much as 5% of a company’s revenue.

7: The place in line Prince Harry’s newborn son, Archie, holds in the royal succession.

–Deniz Cam; Forbes Staff