From a distance, Kariuki Gathitu looks like just another kid you would pass on the street without blinking. He wears jeans, sneakers and a backpack; he sips milkshake and hangs with his friends. But in Gathitu’s backpack are big dreams and a business plan aimed at making him one of Kenya’s first tech billionaires within five years.

Gathitu, a 28-year-old systems architect, is one of East Africa’s new breed of technopreneurs—the hip ones with big ideas who make their fathers’ generation sit up and take notice. They are the whiz kids who command respect. Never before has it been this cool to be a geek. After the international success of Safaricom’s M-PESA, more and more technologists under 35 are mushrooming in Kenya’s large cities. Backed by government-sponsored training, these computer geeks are emerging by the score to build a sunrise industry in what is being called the Silicon Savannah.

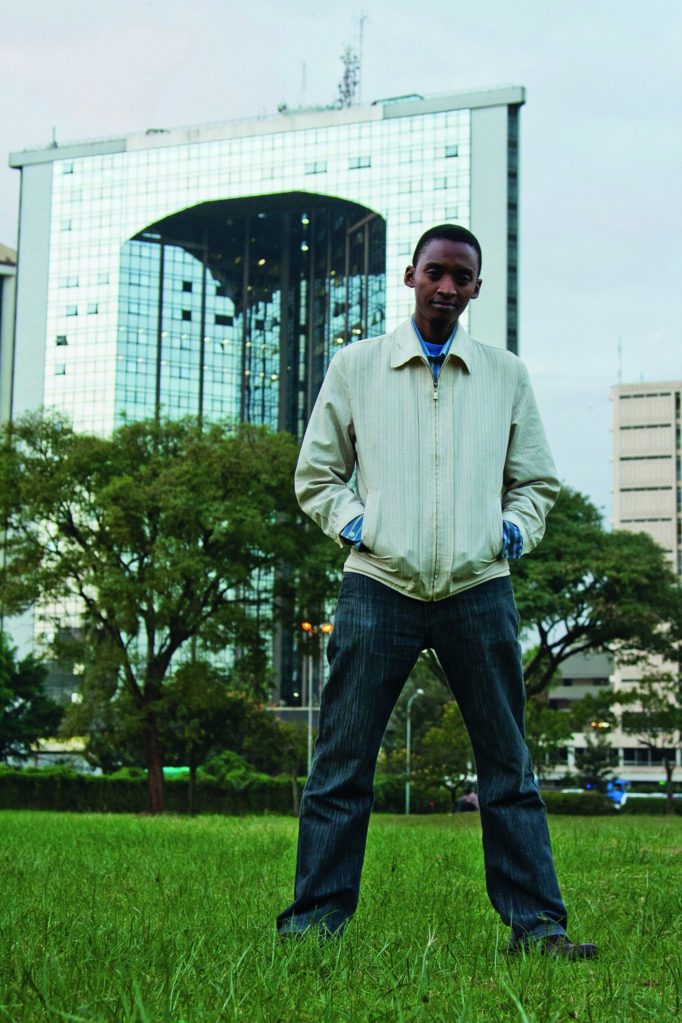

Kariuki Gathitu

“The world has changed and so has technology. These youngsters see the world from a different perspective and they are constantly seeking ways to make life easier,” says Soud Hyder, an independent technologist based in Nairobi. The recent Pivot 25 conference saw the cream of the IT crop from Kenya, Uganda, Rwanda and Tanzania come together for two days in Nairobi. Few delegates were over 30. Gathitu’s company, Zege Technologies (Zege Tech), was among them with its M-PAYER application. On the company’s first anniversary in July, it was raking in tens of thousands of Kenyan shillings and aims to increase its annual turnover to $2 million in the next five years. The company has prospered through a gap in the mobile money system. Often you have to wait up to 72 hours for money to reflect—a major cause of frustration when paying bills. M-PAYER, however, pays in real time. It took Zege Tech three months to come up with the application and another eight months to tailor it for the business market.

In a highly competitive market, Safaricom and Airtel, Kenya’s largest mobile networks, were quick to buy in. Zege Tech won Best Product in the Young Innovators category at the AITEC banking and technology conference in Nairobi in March and visits to the company’s website increased 400%. Gathitu is one of the few young geeks around the world to turn down a job at Google. “In June, I received a call from their office in Switzerland and was flattered as it has been my dream job for a long time. They said I could choose at which office in the world I would want to work. Unfortunately, I had to turn down the offer as there are still a few projects I am working on that will enable many young people to have an easier chance at doing business,” he says. Gathitu is as humble as he is influential. He has just returned from a trip to Malabo in Equatorial Guinea, where he addressed the heads of state at an African Union summit on youth leadership. “It was a great moment when I could speak to Africa’s big leaders. I wanted to give the older generation goose bumps through what the youth is doing. I hope I succeeded with that.

Afterwards I received many invitations to speak at conferences in Angola and Zambia and Mozambique… I’m starting to wonder when I will find time to work,” he laughs. Gathitu hoped to study aeronautical engineering in Britain, but ended up with a degree in Computer Science from the Kenyatta University in Nairobi. He has been fiddling with computers since he was seven. “It became my default career, but now it feels like a fit.” The mobile money transfer system, M-PESA, has put Kenya on the technology map. It allows the user to over come the headaches of sending money internationally, as well as pay bills and purchase goods and airtime through a mobile phone. It is made for Kenya, a country where fewer than 10 million people out of a population of 39 million have a bank account. According to Q2 2011 data released by the Communications Commission of Kenya, there are more than twice as many mobile subscribers—nearly 25 million— as there are bank account holders.

With the support of the government’s ICT Board andinnovation hubs in Nairobi like iHub, young innovators have a chance. It is part of Vision 2030, the Kenyan government’s plan to transform into a middle income country. Paul Kakubo, CEO of the Kenya ICT Board, calls the young techno warriors the Tandaa Generation (‘Tandaa’ is a Swahili word for ‘spread’). In one of his blogs Kakubo writes: “…the Tandaa Generation is what will deliver a lot of the goodies we are looking for as a country. They can create, they are intellectually curious, they are driven, very exposed thanks to technologically delivered media, they are non-tribal, they are good thinkers; they like to be independent. Technology provides them with the tools. What they now need is capital.” Gathitu is riding the wave. He is sharp and ambitious. His company is eyeing South Africa, Nigeria and French speaking West Africa. It hasn’t always been easy.

“One mistake I have made is to over-value a product based on its technological superiority as opposed to market traction. I now believe that a business needs customers more than cash flow,” he says. The time is ripe and the demand is high. Gathitu believes he is well on his way to becoming a tech billionaire before the age of 35. Like many, he trained hard in the years since the first M-PESA transaction in March 2007, and like the rest of the Tandaa Generation, he is ready to rumble.