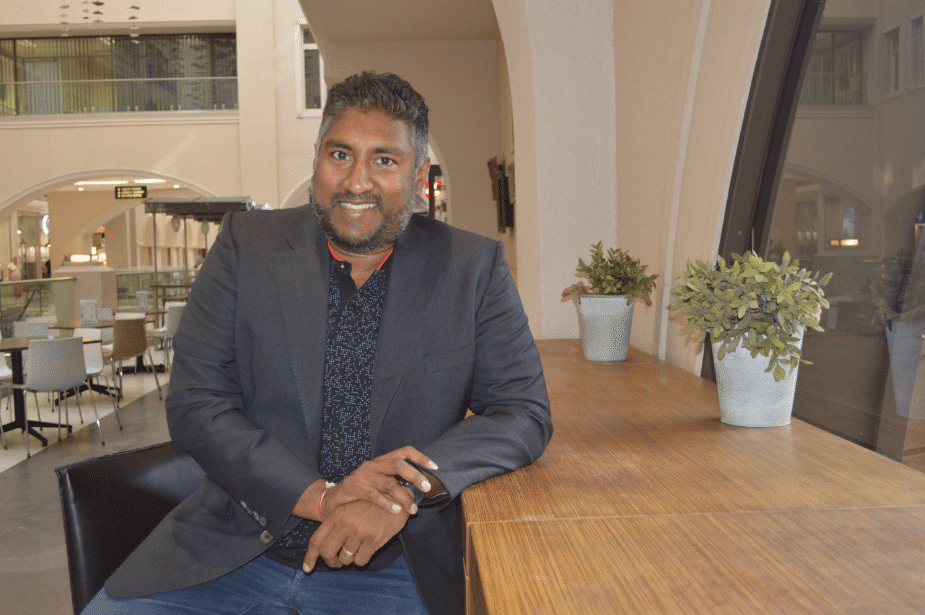

Vinny Lingham, the co-founder of Newtown Partners and CEO of Civic, on investing in bitcoins and putting yourself first.

What is the most interesting investment you have ever made?

I think bitcoin has to be the most interesting. I was an early investor in bitcoin and it is interesting because of the way the whole industry has gone nuts, up and down, and on roller-coasters.

What was your most regrettable financial blunder?

I have got many. I think it was buying fancy cars when I was younger. You go and buy a car that you can barely afford and then you live in a small place.

And then you realize that you may be spending a lot of money on a vehicle instead of either saving or paying off debt. It’s okay to buy cars when you can afford them.

Do you have any particular investment philosophy?

I have lots but you have to build your own investment philosophy that works for you. Everyone has different risk tolerance. Some want lots of risk and others want no risk.

I think the mistake is to take no risk but you shouldn’t risk it [too much] either – so find the right balance.

How does one build this balance and financial discipline?

Have a budget and stick to it. If you have a fixed income, you need to have a fixed income budget.

What do you understand about being financially free?

Financial freedom is an illusion. Because if you really are financially free, it would mean that you are literally sitting on cash and living off interest for the rest of your life.

When you’re young and you make money, you’re free for a while and then you get yourself into the next big project and you are not really free. So, financial freedom can come and go. [Being financially] free forever is very hard to get to.

The only time you are free forever is when you put all your money in the bank and take no risk and if you can live off that income, then you are really free.

But if you keep investing and growing your wealth, you are not always free because you always have to look after your investments. So financial freedom is really hard to achieve if you’re always investing.

Even now when I have a lot of wealth and investments, I am free but I still have to make sure that my investments don’t fail. So, you are still a slave to your investments in a sense.

What are some of the business goals on your bucket list?

It would be interesting to go into an IPO company, I haven’t done that yet.

What are some of the financial lessons you have carried with you since your youth?

Pay yourself first. It is all good saving money, but you have to take care of yourself as well. Don’t live too close to the edge, and be balanced.

– Interviewed by Karen Mwendera