Competition in Africa’s leading stock exchange market is facing a difficult birth. Next year, South Africa could have three stock exchanges, but the Johannesburg Stock Exchange (JSE) has taken the fight against the competition to court.

The Financial Services Board (FSB) granted ZAR X a license to operate on the August 31, paving the way for the first new stock exchange in South Africa for over a century. In a Goliath versus David battle, the JSE filed an urgent application to the FSB Appeal Board to suspend its decision to grant ZAR X a stock exchange license. The Appeal Board dismissed the application.

In a statement, the FSB said Judge LTC Harms, Deputy Chair of the FSB Appeal Board, stated that there was no evidence that the JSE would suffer harm or prejudice.

“He said the JSE’s application was based on the possibilities of harm to the financial system of the country and its investors, which was speculative,” the FSB said.

As ZAR X prepares to launch, Etienne Nel is the man of the moment. He has the mammoth task of taking on Africa’s biggest stock exchange from a small office block in Bryanston, Johannesburg, far from the glamour and glass towers of the JSE in Sandton.

“I’ve basically spent my whole life as a stock broker and in 2011 I co-founded an OTC platform called Equity Express. The explosive growth that we had in that business showed us that there was a very distinct need in South Africa to actually have another stock exchange, away from the JSE, that gives investors another platform to transact on,” says Nel.

In many ways it’s a featherweight taking on a world heavyweight champion. The Johannesburg Stock Exchange is ranked among the top 20 exchanges in the world. ZAR X will have to box clever to survive.

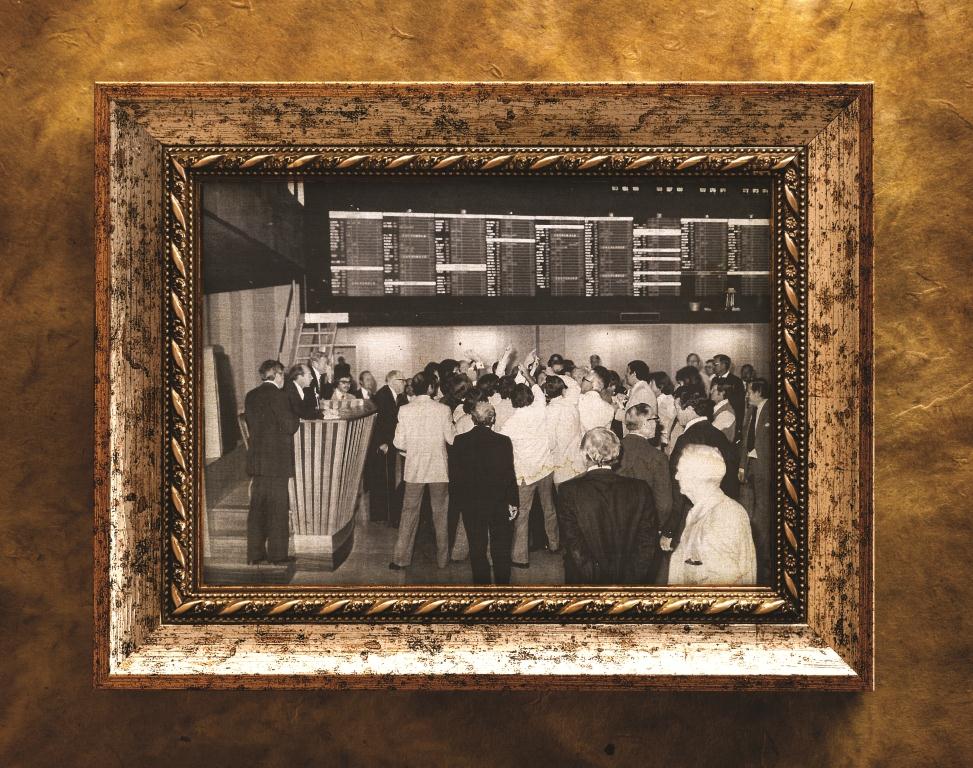

The competition at the dominant JSE has deep roots. It was formed in 1887 during the first South African gold rush. As the days when people chalked up the trades on a blackboard by hand disappeared, the JSE outgrew its former building in downtown Johannesburg. Today the JSE’s market cap is over a trillion dollars. In the last 20 years it has changed fast.

De-regulation swept away piles of paperwork. June 10, 1996, saw the trading floor become electronic and on July 1, 2005, the JSE became a company in its own right.

Today, the JSE handles over 300,000 trades a day, which are worth $1.4 billion.

As its Capital Markets Director, Donna Nemer is responsible for every trade.

“We just have to make sure that as we add new entrants in the market and, as the market evolves, that we don’t lose the standing that we have in the capital markets as a whole,” says Nemer.

An area that ZAR X believes it could steal a march on the JSE is its trade settlement system. An investor using ZAR X’s T+0 (trade plus zero) settlement model can get their money on the same day. It takes three days for an investor using the JSE’s T+3 settlement model.

“We operate on a T+0 model and there is no real reason for anyone to be operating on T+3 anymore. I mean, Australia is on T+2 and they already have plans to go to T+1. We just decided that T+0 is the way to go,” says Nel.

“Our trading regime that we’re accustomed to is one that is called DVP (Delivery Versus Payment) and in those exchanges you exchange the cash and the trade at the same time. In our case it takes three days and I believe our investors wouldn’t want it any other way,” says Nemer.

So how is this big fight going to play out? Owen Nkomo, the owner of an investment management and stockbroking company, is sceptical about the young contender. Nkomo doesn’t know how ZAR X will achieve its T+0 settlement model.

“I imagine it’s going to be very difficult. If they can do it, that’s going to be a very big advantage. People don’t want to wait for shares once they buy them. There are ways of achieving it and if they do then wow, it will work in their favor,” says Nkomo.

ZAR X’s T+0 settlement model helped win over one of the oldest and largest grain producers in Africa, Senwes, in the South Africa’s North West province.

For the last 107 years, Senwes has been growing its way to a sizeable turnover of about $750 million. It’s the biggest trader of white maize in the world and turns out 1.5 million tons a year. After more than a century of tradition, this company is trying something as new as its business is old. It’s taking a chance by listing on a brand new upstart stock exchange.

“An important factor for us in choosing the model that ZAR X has presented is the fact that the investment risk is low because of the trade plus zero rule that they apply. This means that any investor that wants to invest has to have the money upfront,” says Elmarie Joynt, the Group Legal Counsel and Group Company Secretary at Senwes.

So could the grains of Senwes be the grains of hope for South Africa’s first new exchange for a century, or will ZAR X end up being ground to dust by going through the mill of court cases? Investors across Africa will be waiting anxiously to find out.