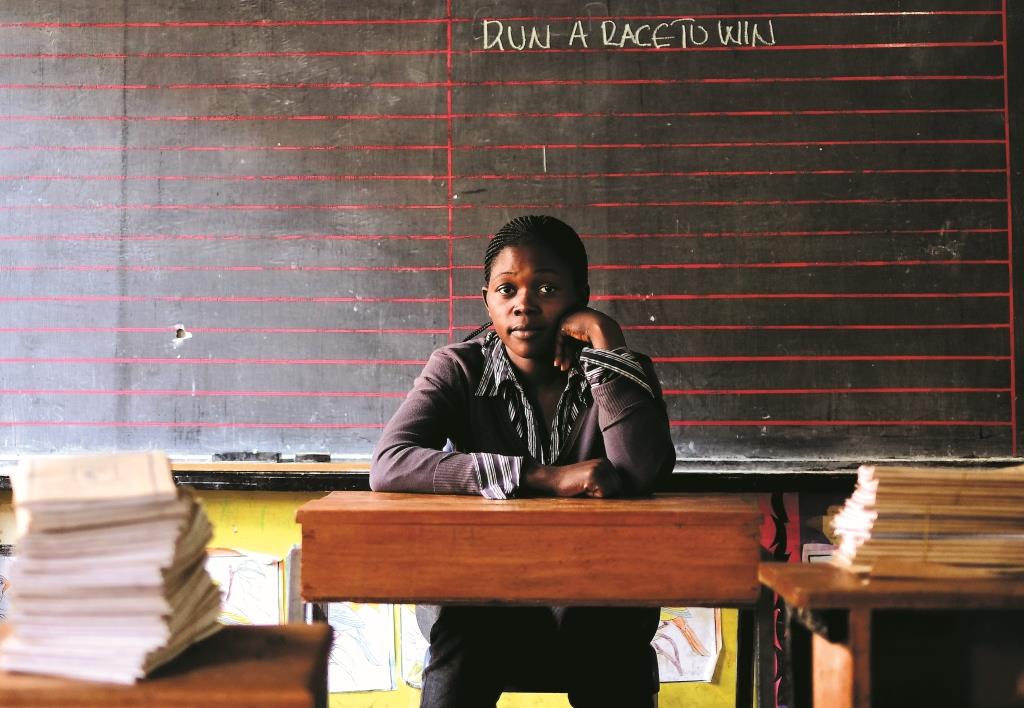

It was a business born of tragedy in Uganda. When Best Ayiorworth’s father died, it spelt struggle. She dropped out of school for lack of money. But it led her to starting a microlending business at the age of 19.

Ayiorworth was just 12 years old when her schooling came to an abrupt halt. Her unemployed, widowed mother tried her best to get all her children through school. But she died trying. It was left to Ayiorworth’s eldest sister and brother.

“When I was around senior 2, the brother who follows her and my other sister intervened and started pushing us ahead. So I managed to reach senior 4, but they could not go further than that. I wanted to go further. I wanted to join A-level, go to university, but I couldn’t,” says Ayiorworth.

“Meanwhile the same problem I got was that even if my mother didn’t die, I was going to face something of that kind because I saw it happen to my big sisters.”

Often in Uganda when families struggle to put their children through school, the girl is forced to stay at home. A lack of support from parents and girls reaching puberty add to the pressure leading to young girls dropping out of school, even in areas where schooling is relatively cheap.

“That was actually one of the biggest problems. I grew up seeing that and me dropping out was a blow. That is actually something that awakened everything that was in me. I always saw those things happen around me. It was not something that made me feel like ‘oh I have to do something,’ but when I had to drop out myself, that thing pained me. It pained me like crazy,” she says.

All was not lost for Ayiorworth. Her elder siblings encouraged her to attend vocational training schools where she learned catering. The director of the school saw something in Ayiorworth.

It led to her joining KampaBits, a youth-based ICT organization that improves the lives of those living in informal settlements. It’s here that she learned graphic and web design. During the course at KampaBits, Ayiorworth joined S7 Project, a skills empowerment center in Kampala. While there, a firend of the founder of S7 Project, Laura Fredrick, helped her get her first job as a chef at Little Donkey, a small Mexican restaurant in Kampala.

Ayiorworth and Fredrick had talked of the idea of keeping girls in school, with the help of a goat. At the time, at 19 years old and having grown up in a village, it was inevitable that her first idea would be inspired by the environment she grew up in.

“I wanted to get goats and give it to girls or their guardians. So when the goat gives birth, after three months I get back the kids if they are two or three and I leave the goats with the girls so that it can give birth again. And the goat can help the girl. They can either sell it or it keeps giving birth and it multiplies and the girl is supported that way,” she says.

The only problem was Ayiorworth didn’t have money to buy a goat. She went back to the drawing board and came up with another idea that would win her awards.

“I knew the community where I came from and I knew the pettiest businesses that mothers could do and they could earn something for me. [I thought] maybe I should support the mothers with that category of girls, with the business so they can support the girls,” she says.

With her first salary of $40 she earned from Little Donkey, she made loans to 10 women. They sold anything from second-hand clothing to fried peanuts.

The business ran for about three months allowing Ayiorworth to save around Ush300,000 ($110), catching the attention of the S7 director. He was so impressed that he loaned Ayiorworth about Ush800,000 ($295) at 2% interest.

Ayiorworth registered Girl Power Micro-Lending Organisation (GIPOMO) and structured it so that the education of girls was tied to loans.

The women are grouped in threes as a prerequisite in getting a loan, of which they pay a monthly 10% interest.

“If I give you Ush10,000, you have to bring back Ush11,000. Then I can give it back to you right away. The idea is to make sure the money is secure. The interest remains and I give you back the Ush10,000,” she says.

It was far from easy. About nine months into the business, two women ran away with USh400,000 (around $150). Ayiorworth did not allow that to dissuade her. She put in new guidelines and carried on.

One of which was if a girl that was supposed to be educated from the scheme complained three times, the guardian is booted off the scheme.

GIPOMO’s success for having developed and implemented an innovative solution to a challenge facing Ayiorworth’s community garnered her the Anzisha Prize in 2013 for young African entrepreneurs. She ploughed the $25,000 prize money into her business, boosting her savings pool to over Ush45 million ($16,500).

Her passion for education for young girls has encouraged her to implement other projects like Women in Agriculture where women are helped to make money off it through planting crops that are sold to other companies at a cheap price. GIPOMO makes a 5% interest from the sales.

Although Ayiorworth started GIPOMO as a class project, it is still going strong.

Today, GIPOMO has registered over 65 women, but there’s another 200 still waiting to join. It is revolutionizing girls’ education

in Uganda.

It just goes to show what the failure to afford a goat, followed by a good idea, can do.