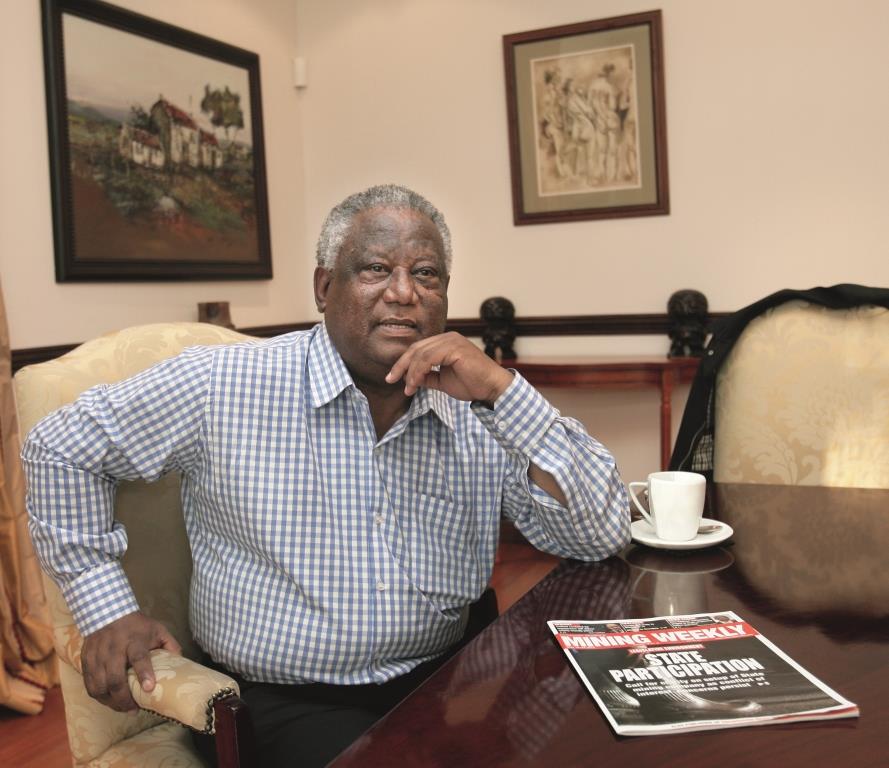

“Finally, after a turbulent seven years, we are on the brink of making history,” enthuses Zwelakhe Sisulu, a journalist-turned-magnate who believes manganese will eventually “do for South African mining what gold and diamonds did” back in the heyday.

The chairman of Kudumane Manganese, one of South Africa’s newest mining companies, makes the remark at a time when one of the doyen families of South African mining, the Oppenheimers, is exiting amid plummeting revenues. In November, Nicky Oppenheimer put an abrupt end to his family’s century-old hold on the diamond industry. He sold his 40% stake in De Beers, the world’s leading diamond company, to Anglo American for $5.1 billion.

Sisulu is finding it difficult to contain his excitement. And it’s not because his company is making money, just yet, but because when it does, it will make bucket loads, for thousands of years.

South Africa is one of the most resource-rich nations on earth, with mineral reserves estimated at more than $2.5 trillion, according to Business Insider. Manganese makes up a big part of that wealth, with the country known to have between 85 and 92% of the world’s high-grade manganese ore reserves. However, there’s something anomalous about how South Africa benefits from world manganese trade. It produces only 15% of the world’s manganese, compared with China, which produces more than 35%, a lower grade at that, and has less than 5% of the world’s manganese reserves and resources.

Most of the country’s reserves are found in the Northern Cape, in part of the Kalahari Basin, a large area covering 2.5 million square kilometers and straddling South Africa, Botswana, Namibia, Angola, Zambia and Zimbabwe. Most famous for having the biggest mineral deposits in the world, the basin is home to diamond, manganese, iron ore, zinc, copper and a host of other minerals. It also has a significant presence of limestone, gypsum, granite, verdite, mica and rose quartz.

South Africa’s new, albeit slow, manganese rush began more than seven years ago when Sisulu’s Kudumane Manganese—as well as several other consortia including Kalagadi Manganese and Tshipi é Ntle Manganese Mining—were granted prospecting rights that were later converted to full mining rights.

Thanks to the country’s policy of Black Economic Empowerment (BEE), the mines became post-apartheid South Africa’s first green fields projects to be commissioned on such a grand scale and with significantly higher local black ownership.

Three years before, the South African parliament adopted the Mineral and Petroleum Resources Development Act in 2002, which compelled all existing mining houses, including world leaders like Anglo American and De Beers, to cede at least 26.1% of their shareholding to blacks as a means to redress apartheid. The government then promised to ensure that henceforth, any new rights issued would be even better for the locals—guarantee them larger stakes, skill greater numbers of indigenous people, encourage innovation and find more sustainable ways of mining.

Collectively, it is estimated that the new mines have enough reserves to last the next 5,000 years. They are all also building sintering plants so they can participate more meaningfully in the mineral’s value chain—something old mines didn’t do much of.

Delighted that theirs are “genuine deals”, Sisulu says “there was a lot of paper shuffling” and complacency in previous mining BEE transactions. “Blacks did not care about running a mine. One thing I’ve learnt is that you’ve got to dirty your hands in this business.” Insisting he’s “not reading a political catechism”, he says the new manganese dispensation has given Africa’s biggest economy “a golden opportunity for genuine ownership of assets by blacks, as well as a genuine rise of black professionals. If you look at gold and platinum mining, they remain exclusively white.”

When FORBES AFRICA talked to the budding oligarchs, they had all achieved critical mass. Some are now readying themselves to transport ore to their customers across the globe, while others are about to go into full production.

But it hasn’t been an easy road.

Over the years, the new miners lost a great deal of time and energy in bun fights over the “arranged marriages” the government forced them to enter into with international partners. None were afforded an opportunity to choose their foreign investors.

“The issue of forced marriages was a serious one,” laments Tshipi é Ntle Manganese Mining chairperson Sakumzi Macozoma, “besides the issue of compatibility, there were issues of investment horizons and simple diligence in doing the work that needed to be done.” He considers himself “lucky, in that our consortium worked well from day one”.

Sisulu admits to having it rough in the beginning, but is now pleased that “reason ultimately prevailed” and the relationship between them and their Japanese strategic equity partners is “working like a charm”.

Daphne Mashile-Nkosi, who heads Kalagadi Manganese, has not been as fortunate. The single-biggest shareholder and chairperson of Kalahari Resources has been in constant disputes with the bigger of her two strategic equity partners, giant steel maker ArcelorMittal International which owns half of Kalagadi. It took a High Court order to force ArcelorMittal to meet a R241.3 million shareholders’ agreement with Kalagadi. ArcelorMittal had expressed unhappiness with the way the business was being run by the local partner, claiming that certain material obligations under the Kalagadi Manganese shareholders agreement had been breached and that corporate governance was found wanting in the mining firm. ArcelorMittal also wanted to appoint a joint CEO. The High Court also ordered the company to pay the costs of the legal proceedings and ruled that ArcelorMittal discharge its financial obligations in the future, pro-rata to its shareholding in Kalagadi Manganese.

SOUTH AFRICA – 6 August 2009: Saki Macozoma is the chairperson of financial institutions STANLIB and Liberty Life, deputy chairman of the Standard Bank of South Africa and a director of the Liberty Group. (Photo by Gallo Images / Financial Mail / Robert Tshabalala)

Other stumbling blocks remain. Transport, over which they have little control, is one of them.

Transporting manganese by road would cost the mines around 75% more than rail, the miners say. But they may not have to go that route, if the government delivers on its promise. After years of shirking its responsibility, the government has finally decided to come to the party.

In February, President Jacob Zuma announced that government-owned transportation utility Transnet would spend R300 billion ($36.7 billion) to increase railway capacity, build and improve port facilities and upgrade fuel pipelines. The plan is specifically aimed at speeding up resource shipments and includes a new railway line to transport 16 million tons of manganese to Coega, a new development zone that’s at the center of the world’s main trade routes, being equidistant from American, European and the Pacific Rim regions.

“It’s going to take time but we are happy it’s finally going to happen. The imponderable here is why did we wait? We knew it had to be done. But it’s not too late,” says Sisulu.

In a country where most leaders of mining consortia are, or were, politically well-connected, some may find it strange that Sisulu and Macozoma would not have been able to do something about the situation they are now finding their companies in.

Zwelakhe Sisulu’s father, Walter, recruited Nelson Mandela to the ruling, 100-year-old, African National Congress. The two went on to become close friends and each other’s confidantes when they were both incarcerated for close to three decades for political activism. When Mandela was released in 1990, Zwelakhe went on to become his press and private secretary.

“No-one would see Madiba if I didn’t want them to see him,” is how Sisulu best describes his role in Mandela’s life at the time.

When Mandela retired from active politics after serving a five-year term as head of state, Macozoma became one of the most powerful men in South Africa. A close confidant of Mandela’s successor, Thabo Mbeki, Macozoma formed the nucleus around whom Mbeki’s inner circle was built. Like Mandela, although much younger, he is also a former Robben Island prisoner.

But transport is not the only challenge the new miners are facing. Across the South African mining industry, output has dropped. Unrest and wildcat strikes have reared their ugly head. And the country is facing stiff competition from fellow African countries like Gabon.

All this is happening at a time when worldwide demand for manganese has slowed. South African Chamber of Mines figures show that primary manganese ore production increased by 57% in 2010 to 7.1 million tons, coinciding with the global economic recovery. Of the total production, 5.9 million tons were exported while 17% was consumed locally. Total sales amounted to R10.6 billion and the industry contributed 1.5% to the country’s total merchandise exports.

Right now the figures are nowhere near there. But when that upward curve comes again, Sisulu says, they will be able to take advantage: “For as long as you produce steel, you are going to need manganese.”

Manganese is widely used for steel production, to give it strength, hardness and durability. The metal’s demand is being driven, in the main, by the infrastructure, transport and other development needs of the world’s nations, especially the most populous and resource-hungry ones, like China, which accounts for half the world’s steel and iron production and consumes 676 million tons a year.

Imara SP analyst Stephen Meintjes says: “Short- to medium-term consolidation is likely until steel prices and consumption turn up again. This might dislodge some high-cost Asian producers facilitating more realistic prices in due course.”

South African manganese will eventually perform to its full potential in the world market, he reckons, and “nothing, except our vexed mining jurisdiction problems” will stand in its way.

Macozoma says: “Conservative estimates of world production of steel, in which manganese is a key ingredient, suggest that, barring the usual economic cycles, is going to be strong for the next 50 years or more. This is based on the urbanization rate in the world, which requires extensive infrastructure.”

So, will manganese be as good as gold, as Sisulu surmises?

“Way too optimistic, something like iron ore, which of course is still very good, maybe,” says Meintjes.

“Manganese is different from gold in that the latter was a store of value worldwide and was viewed as wealth in itself. Manganese is an industrial mineral so it depends on the levels of steel production in the world,” says Macozoma

That said, he quips: “Manganese is not a 20/20 game for South Africa. It is a five-day cricket test.”