Mastercard knows only too well that technology can drive inclusive financial growth with simpler and more efficient ways to do business and life. And Raghu Malhotra, the man spearheading this trajectory in Africa, is also focused on social progress.

In many ways, Raghu Malhotra is like the brand he works for, leaving his footprints in different parts of the world, and in some cases, the most unlikely corners.

On a scorching summer’s day in June 2016, Malhotra traveled 100km east of Jordan’s capital city Amman, to a camp with white tents named Azraq built for the refugees of the Syrian Civil War.

In the desert terrain and hot, windy conditions, people had to queue for hours on end for plates of food handed out of visiting trucks. But some of them, displaced and homeless overnight, expressed their gratitude to Malhotra, President for Mastercard in the Middle East and Africa (MEA).

Mastercard, a technology company that engages in the global payments industry, had distributed e-cards, as part of a global collaboration with the World Food Programme, to the refugees that they could now use to purchase food and other supplies from local shops.

READ MORE | The Big Bank Theory: South Africa’s Banks Of The Future

“I spoke to the people myself and saw what their lives were… Even those who were doctors with their families and were displaced… They said to me ‘you have restored dignity to our lives; you have no idea how demeaning it is to queue up to be given food’… We actually digitized how that subsidy for food was given. Some of these things go beyond economics,” says Malhotra.

Beyond economics.

That very simply sums up Malhotra’s mandate for Africa as well.

The New York-headquartered Mastercard, ranked No. 43 on Forbes’ list of the World’s Most Valuable Brands, with a market cap of $247 billion, which connects consumers, financial institutions, merchants, governments and business, is fostering key partnerships across the African continent to help drive inclusive economic growth.

The idea, Malhotra says, “is to get our global skill-set to operate in its most efficient form in every local economy, at the same time, we must do good, and it must be sustainable.”

He calls Africa the next bastion of growth for various industries.

“As a company, we have stated we are going to get 500 million new consumers globally. And Africa plays a big part of that whole story… We want to be an integral part of various economies here,” says the man responsible for driving Mastercard’s global strategy across 69 markets.

“It probably took us over 20 years to get the first 50 million new consumers, in my part of the world, which is the Middle East and Africa (MEA). It took us probably five years to get the next 50 million, and last year alone, we put over 50 million consumers [in the formal economy] in MEA. That is part of our whole African story, so this is just not rhetoric; we are actually building our business on that basis.”

Home to four of the world’s top five fastest-growing economies, Africa has the fastest urbanization rate in the world, the youngest population, and a rapidly expanding middle class predicted to increase business and consumer spending.

It’s a continent of opportunity for global players like Mastercard with an eye on the potential of a booming consumer base and small and medium entrepreneurs, most of whom are still not a part of the formal economy. A large proportion of Africa is still unbanked. There is enough business opportunity in offering people digital tools so they can lead respectable financial lives.

READ MORE | The Monk Of Business: Ylias Akbaraly Talks About Secret To Success And Plans To Take Africa With Him

But it is in knowing that financial inclusion is not just about technology, but more about solving bigger problems, as the World Bank says in its overview for Africa: “Achieving higher inclusive growth and reaping the benefits of a demographic dividend will require going beyond a business as usual approach to development for Africa. Going forward, it is imperative that the region undertakes the following four actions, concurrently: invest more and better in its people; leapfrog into the 21st century digital and high-tech economy; harness private finance and know-how to fill the infrastructure gap; and build resilience to fragility and conflict and climate change.”

And in order to enable financial access, Mastercard has a balanced strategy in place, with the right partnerships for inclusive growth on the continent, Malhotra tells FORBES AFRICA.

“Every emerging market has different segments of people and you need to get the right product for the right segment. What we do is a balanced growth strategy across the continent based on timing, opportunity etc… Of course, because the bottom of the pyramid is much bigger, I think what we need is to adapt things differently; that is where the inclusive growth story comes from. That is where the opportunity is, but there is a second part to it…” And that, he summarizes, is advancing sustainable growth, doing good and bringing more transparency and efficiency.

The new pragmatic dispensation of governments in Africa towards ideas, technology and innovation has surely helped open up the stage to newer segment-driven products, especially as Africa already has such global laurels as Safaricom’s mobile money transfer and micro-financing service M-Pesa that took financial access to a whole new level. Also, sub-Saharan Africa remains one of the fastest-growing mobile markets in the world.

READ MORE | Feisty And Fearless Pioneers Thandi Ndlovu & Nonkululeko Gobodo

Malhotra says he finds African governments consistent in how they are rolling out their digital vision, and in trying to collaborate towards creating better ecosystems for their economies, though each is unique with its own dossier of problems.

“When I speak to various governments around Africa, I see a commonality of what their needs are and I also see a commonality in how they are trying to respond. So I think a lot of them realize running cash economies is a very inefficient way of doing things… Also, the consumer base is much more open to new technology because there is no bedded infrastructure or legacy infrastructure. I think where governments need to start thinking a bit more is how much do they want to do completely on their own.”

Part of this transformation on the path to financial progress is alleviating the burden of cash. Cash still accounts for most consumer payments in Africa. Mastercard, which started out as synonymous with credit cards, continues its efforts to convert consumers from cash to electronic transactions, and move beyond plastic.

A cashless continent?

In an interview with us in mid-2016 in Johannesburg, Malhotra had said: “People consider the likes of Facebook and Apple as digital giants that have transformed things, and they really have, but if I really think of a company that 50 years ago digitized cash, I would like to believe we were the pioneers of what is called the digital economy. Obviously, you require technology and infrastructure to continue the transformation.”

And the first challenge to converting a cash economy to electronic is education.

“There is a common perception cash is better. But if you lose your wallet, and if you have cash in it, you will never see your cash again but you actually have a chance of getting your card back. Secondly, cash is a very inefficient form. Somewhere, the world has forgotten it started with the barter system: you moved to mineral trade, then diamonds and gold, you changed that to coins, silver and gold, you changed that to bullion and then moved to cash. Cash has been a phenomenon only for the last 600 years or so. The time has come to digitize it. Why can’t we just accept that and move forward?

“Once you get over that hurdle, you start with infrastructure, and that’s where partnerships with governments and different stakeholders come into play,” he had said.

It’s these conversations and partnerships that have been bringing the Dubai-based Malhotra to Africa’s shores several times a year. During our interview in July this year, he said: “Just to give you a flavor, I visited four African countries over the last 15 days.”

Mastercard is ramping up investments and expanding its reach across Africa. New offices have opened in Senegal and Cote d’Ivoire, with another on course in Zimbabwe. There are more people on the ground, closer to the local markets. Over the last five years, the company’s employees in Africa have gone up by over three times, and 40% of all new hires in MEA are in Africa.

The company has also stepped up the backing of African fintechs, investing in a number of firms such as Flutterwave and DukaConnect, and e-commerce platforms such as Jumia. In Rwanda, Mastercard has provided a grant of $1 million, spread over three years, to advance economic growth and financial inclusion.

In 2015, the company opened its first Lab for Financial Inclusion in Kenya partnering with the Bill & Melinda Gates Foundation. Some of the innovations made here are then exported to other parts of the world, attests Malhotra.

“We have some outstanding examples of products and platforms that have been created in Africa.”

Agriculture is one of the focus areas alongside education and MSMEs (micro, small and medium enterprises).

One of the thrust areas for Mastercard is a farmer network that connects buyers and sellers of farming goods, providing them with a digital identity and enabling them to sell produce, buy inputs and receive payments for seeds and fertilizers via their feature phones, bringing more transparency into the value chain.

The other example is Kupaa, a digital payments tool that is making paying school fees easier by allowing caregivers to pay them via a basic cell phone in small amounts and allowing multiple individuals to contribute funds to the child’s education.

“Most people at the bottom of the pyramid cannot afford to pay school fees on a monthly or quarterly basis, but they can on a daily basis, if they are daily wage-earners. We have created a platform that is almost like crowd-funding that allows to pay for kids’ education,” says Malhotra.

“There are many global organizations that looked at this model saying that it is truly a real example of public-private sector partnerships that are about inclusive growth. I am very encouraged on how other people are taking to these platforms.”

Solar energy is also in the mix, with a product called M-KOPA enabling Ugandans to have power in off-grid homes. They make ‘pay-as-you-go’ Quick Response (QR) transactions for solar energy solutions.

“Clearly, we are trying to do things differently in bringing many platforms and cobbling them together… You should expect more and more such innovations coming from us in the future,” says Malhotra with exuberance.

Salah Goss, Vice President and Head of Mastercard’s Lab for Financial Inclusion in Nairobi, who has had extensive experience in the financial inclusion arena, calls it a “human-centric design”.

“It’s about giving communities that are excluded access to services they care about; it’s not financial inclusion just for a bank account, but to support an economic livelihood. It’s about adding efficiency and choice, safety and security. And that happens with digital. We are laying the superhighway of digital transactions, so, people can benefit and connect to the global economy,” says she.

What Mastercard has also realized as important is partnering with – rather than countering – mobile network operators to build a stronger payment ecosystem on the continent.

READ MORE | The Madhvanis: The Industrialists Who Have Tasted Sucrose And Success

“I admire the mobile companies on how they became interoperable between themselves, [and that] is how they created scale. Because they created scale, the cost of hardware went down very dramatically,” says Malhotra.

“The concept of interoperability is really important… It’s the right way of doing things for the consumers. I feel mobile companies have suddenly embraced that and therefore, our partnership with mobile companies is exactly in the same line, saying can we drive efficiency and scale for you to create the right value you want to create for your customer. So it is about working together with them on various points.”

Another important focus is Mastercard’s investment in women, who are traditionally underserved in Africa. Goss says they “suffer from financial exclusion, and part of the work is to break the cycle of invisibility”.

For instance, according to the Mastercard Index of Women Entrepreneurs in 2018, only 18.8% of South African business owners are female, compared to 46.4% in Ghana, which is ranked as the country with the highest women-led companies in the world. This number could be improved, with the right support to aspiring female business-owners.

‘The purity of the people in Africa’

This year, Malhotra was appointed as a member of the United States’ (US) President’s Advisory Council on Doing Business in Africa. His role will be advising the president of the US, through the secretary of commerce, on ways to strengthen commercial engagements between the US and Africa.

“I am honored to be on that council… It’s going to have various facets to it. I don’t have all the details as yet, but the idea is to say ‘hey listen, Africa is a continent on the move, many things are changing’. It’s a look into the future as well and to also, hopefully, try and address the various barriers that currently exist to ensure better commercial arrangements between the US and Africa.”

Coming out of the aegis of the US President’s Advisory Council, adds Malhotra, is Prosper Africa, an initiative that unlocks opportunities to do business on the continent, to increase two-way trade and investment between the US and Africa.

All this will see Malhotra intensifying his trips to Africa, a continent he has been visiting for the last decade. Yet, each time, even before he lands on African soil, he says he is captivated by its beauty.

“I don’t think the world has really understood how beautiful this continent is. The first thing that stood out for me when I came out of a plane in Africa, was the sky,” he recalls. “I find purity in the environment. Every single time I go to an African country, when I look up, it gives me the same feeling. It doesn’t matter whether it’s a rainy day or how the clouds are on a clear day. There is something there, so when people say that humankind was born in Africa, I kind of get it. The purity of African nations and the people is a real joy. Through all the chaos, there is purity. That’s what stands out for me.”

With a career spanning more than 25 years, prior to joining Mastercard in 2000 in New Delhi, Malhotra, the son of an army colonel in India, served in a variety of roles at Citicorp, American Express and ANZ Grindlays Bank.

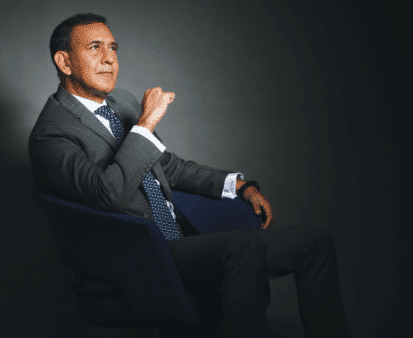

“I joined Mastercard because I wanted to join a company where I wanted to run a business slightly away from banking. Nobody in the world was willing to give a risk manager the job as a head of a business. But Mastercard gave me a chance. I used to run area countries for South Asia and then I realized what a great industry it was. There was a huge shift taking place with the world moving to a digital form. That is really where my journey with Mastercard began,” says the lean leader, nattily dressed in a grey power suit for FORBES AFRICA’s cover shoot in Johannesburg.

There is a disarming smile when you quiz Malhotra about his favorite Africa sojourns. Top of the list was his impromptu visit to Victoria Falls on the border between Zambia and Zimbabwe, following a business trip in South Africa.

“I was in South Africa and had a choice to fly all the way out to Dubai, and I said ‘forget it, I am going to go hiking’ and decided to go to Victoria Falls [in Zimbabwe]. I hiked, went ziplining over the gorge, took a helicopter ride over the falls, and did a boat ride through the river. I felt one with nature, and very much in harmony with the land.”

He experienced similar exhilaration many years ago in Argentina, when on his own, he went glacier-climbing over a weekend, after a business trip.

“You are just alone and at that point of time, maybe it must be the rarefied air there, I got clarity in my head and I started thinking it’s really nice to be by yourself from time to time, as busy as you are, being the leader you are, the husband you are, the father you are or could be, or the uncle you could be. If you don’t spend time with yourself, you are not really being your whole self. This just means don’t spend all your time trying to make other people happy, take some time off for yourself too, and I think that really helped me,” says Malhotra as advice to fellow business travelers living out of a suitcase most of the year.

READ MORE | How mogul Abdulsamad Rabiu has become a billionaire again

Back home in Dubai, the other half of the power couple is Malhotra’s successful banker-wife Banali. They have two daughters, aged 19 and 11.

Soon coming up in the glistening Middle Eastern city, is Expo 2020, which Mastercard is partnering with, rolling out a raft of its payment, biometric, AI and wearable technologies. The glitzy showcase will draw tourists from around the world for “a converged digital experience”.

But Malhotra will be back to Cape Town in February, he promises, to celebrate his 50th birthday. There is no other place but Africa he would rather be, to mark his next crucial milestone.