The telecommunications landscape is thriving – well-nourished by the plentiful possibilities of diversification, digital transformation and fintech solutions. This much was evident as leading mobile money and fintech business CEOs gathered in a landmark session at Mastercard Collaborate to Innovate, an annual gathering that invites businesses to discover new ways of embracing disruption and redefining the future.

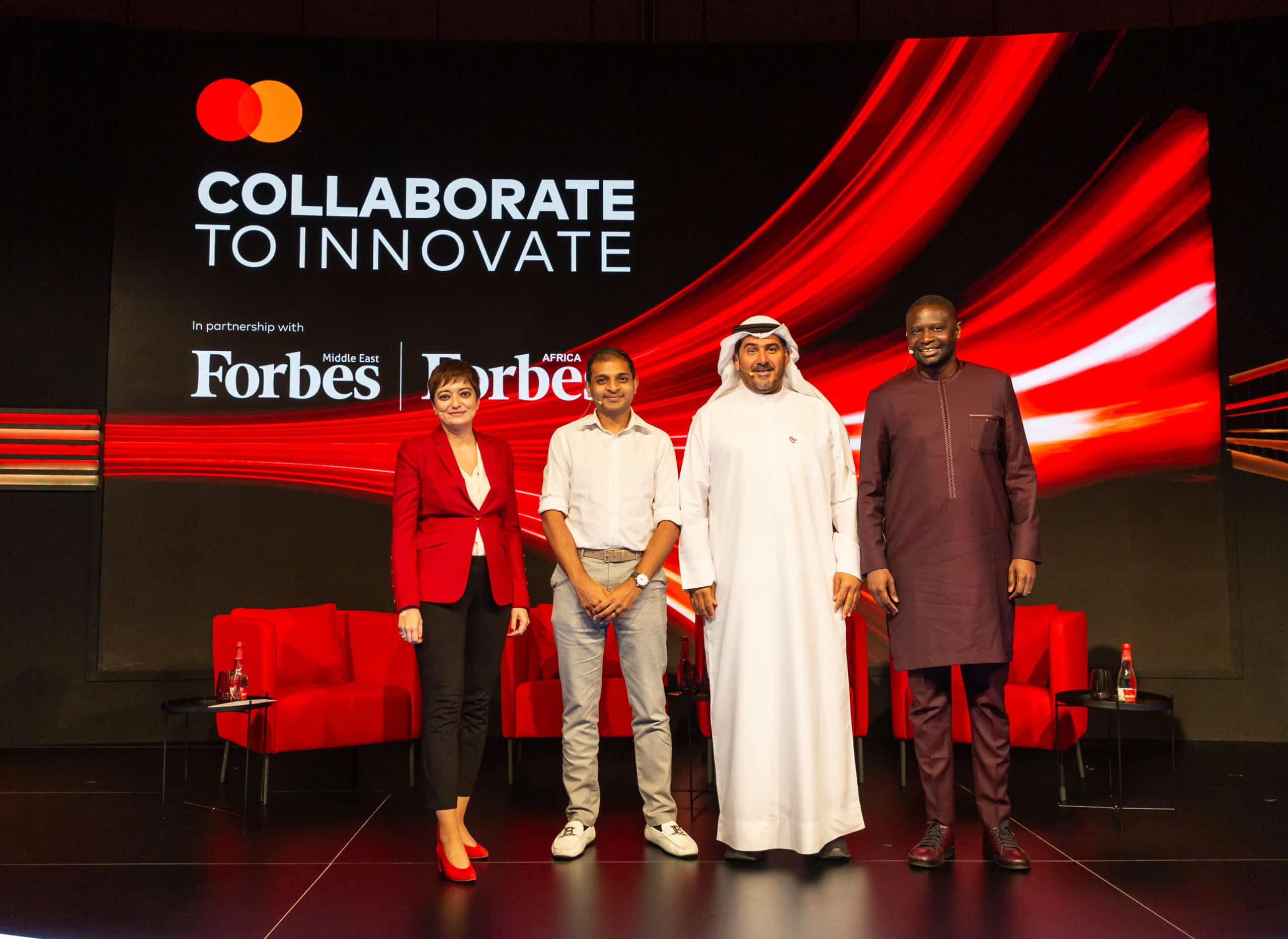

In one of the event’s most anticipated sessions, three leaders in the telco-fintech transformation space – Airtel, e& and MTN – gathered on one stage to share their thoughts about the future of mobile money and their evolution from one-time pioneers to mainstream movers and shakers.

This is because, in some respects, mobile money is becoming more valuable than the core telco business of operators, presenting an interesting challenge in shifting the mindsets of stakeholders. However, with new separate divisions within the businesses, there is now also a chance to give greater visibility to investors and shareholders into fintech, so that mobile network operators can become the fully fledged financial services businesses that can drive future growth.

As Ian Ferrao, CEO, Airtel Money put it, mobile network operators have come a long way. “Telcos started out as engineering businesses, then became marketing companies, and eventually developed into retail. Now, it’s very much a customer-first outfit, focusing on how we can meet the needs of our customers with the right technology.”

Mobile money has disrupted the way whole economies work, especially in Africa, where the amalgamation of largescale mobile phone adoption and accessible mobile financial services leapfrogged the traditional finance infrastructure. “It’s been a privilege to see the way mobile money brought prosperity and bridged the divide,” continued Ferrao.

Centralizing our product design and experience around the customer is definitely a focus area, emphasizes Khalifa Al Shamsi, CEO, e& life. “As we double down on pioneering our digital businesses that combine both technology and product innovation, we’re continuously looking to address the diverse customer segments needs with a commitment to agility and adaptation based on regional variations in digital experience expectations.”

Along with knowing where to focus, the fintech leaders also highlighted that the ‘how to get there’ is equally important. “The key to success is excellence in execution, by deploying the right strategy at the right speed, because that will lead to partnerships that can fuel growth in the right direction,” says Serigne Dioum, Group CEO, MTN Fintech.

“To move from telco to techco, we have to build the right platforms that can offer the right value proposition. This is where the right partners can add value. The future is in partnerships, enablement, access to assets, service to customers, and a superior customer experience via the best-in-class apps,” Serigne continued.

What do they think of the competition? “We’re all competing against cash,” said Ferrao. “The market is still underpenetrated. Together we’re building a cashless society that supports financial inclusion, offering people and small businesses the chance to realize transfers, savings, loans, payments, insurance, wealth building, and much

more, especially as a new middle class in Africa emerges. Customer centricity is essential and adapting at speed is imperative. This is only possible by simplifying Technology stacks and IT architecture, and addressing the culture of an organization so that there isn’t an inherent resistance to change.”

Amnah Ajmal, Executive Vice President, Market Development, at Mastercard Eastern Europe, Middle East and Africa who hosted the panel discussion, emphasized the value of mobile money solutions for SMEs, especially in Africa, where they drive a significant part of the economy, community employment and trade.

“Mobile money solutions help SMEs to grow and scale faster, expanding their customer base quicker, improving their capabilities for financial management, enhancing their operational efficiency, and ultimately increasing profits. SMEs, are responsible for 90% of the world’s businesses, and more than 50% of employment worldwide. Formal SMEs also create 7 out of 10 jobs. SMEs contribute around 40% of the national income (GDP) in emerging markets which is a game changer. Furthermore, harnessing the power of data to grow commerce can help retailers, small businesses, and customers in various industries where dedicated insights can drive better decision-making,” said Ajmal.

As 5G becomes more widespread in Africa, and more use cases come online, the growth in fintech, mobile money and diversified telco offerings will benefit further. So too will people and businesses. In its capacity as a global technology company in the payments industry, with a full suite of enterprise products and solutions to drive loyalty, growth, and personalization, Mastercard is a key partner for many mobile network operators in the region and beyond.

Ajmal says Mastercard develops strategic digital transformation strategies for telcos and other enterprises by listening to pain points, deploying the relevant technology, and co-creating where new potential emerge. “This is a business of partnerships that leverage complementing capabilities, reach and expertise. From our side, we will continue to tap into new technologies to develop new value propositions that are personalized and contextual, shaping the future of commerce, solving real problems for businesses, and making people’s lives easier.”

DISCLAIMER: Brand Voice is a paid program. Articles appearing in this section have been commercially supported.