Having survived the rigors of Christmas, with UK panic buying now a distant memory, December and January saw a flurry of international trade activity, with deals signed between the UK and Australia, and digital trade deals with Singapore.

And rather than the expected lull in January activity, negotiations commenced towards a free trade deal spanning 5 years between the UK and India. This cements a long-standing history of trade and investment, aimed to increase jobs and revenue in pharmaceuticals, leatherwear, textiles and footwear. Service sectors will also benefit in areas such as nursing, education and IT.

Additionally, the UK Department for international Trade has set its sights firmly on securing membership of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) by the end of 2022, giving access to trade worth USD13.5trillion. Known as TPP-11, the member nations span the Far East, Australasia and South America incorporating such powerhouses as Japan and Singapore.

With this positive step, the agreement aims clearly to increase economic security, enable non-tariff barriers to trade to be removed help to diversify trade links and re-position the UK as a true global hub following Brexit and the challenges brought by the pandemic.

And, by trading with nations already acting in different FTA’s, there should be even greater opportunities, markets and exchange of products and services, to fulfil the ambitions of all the member nations which in turn brings benefits and resources for people to work on problems that all nations are facing, in tech, the environment, healthcare and other sectors.

So, a rosy outlook to start the year. But, major challenges are still ahead, as the worlds’ second largest trading nation, China, with GDP larger than those of the next four economies – Japan, Germany, the United Kingdom, and India – combined, is facing a new reality when looking at sustainability of growth. Despite the intent, collaboration and reach of FTA’s, some countries are maintaining their protectionist, restrictive access, subsidy driven stance.

After its rapid rise, China growth rates have slowed, with the biggest factor being the fall in production in domestic markets, ageing population and reduced numbers of workers estimated to be in the region of 35 million over the next 5 years.

Just as the UK Government has acted to raise the retirement age and keep people in employment longer, China aims to do the same to preserve tax contributions with creation of new jobs.

The global appetite for Chinese goods is insatiable, and as a prime example, the UK imported £40.5bn more from China than it exported to the country in the year to June 2021, a rise of imports from China of 38% increasing the trade surplus to over 670BN USD.

In the same period, UK exports fell by 34%, a picture reflected in many other nations internationally.

China is set on promoting more self-sufficiency, greater domestic consumption and less reliance on the export market long term. But when things go wrong, the repercussions are immense as ‘debt bombs’ are created with companies ‘too big to fail’.

The Evergrande issue is ongoing, with unfulfilled debt obligations of USD 300 Bn, hundreds of unfinished properties now classified as distressed assets, thousands of unpaid workers, millions of jobs at risk and loss of home buyers.

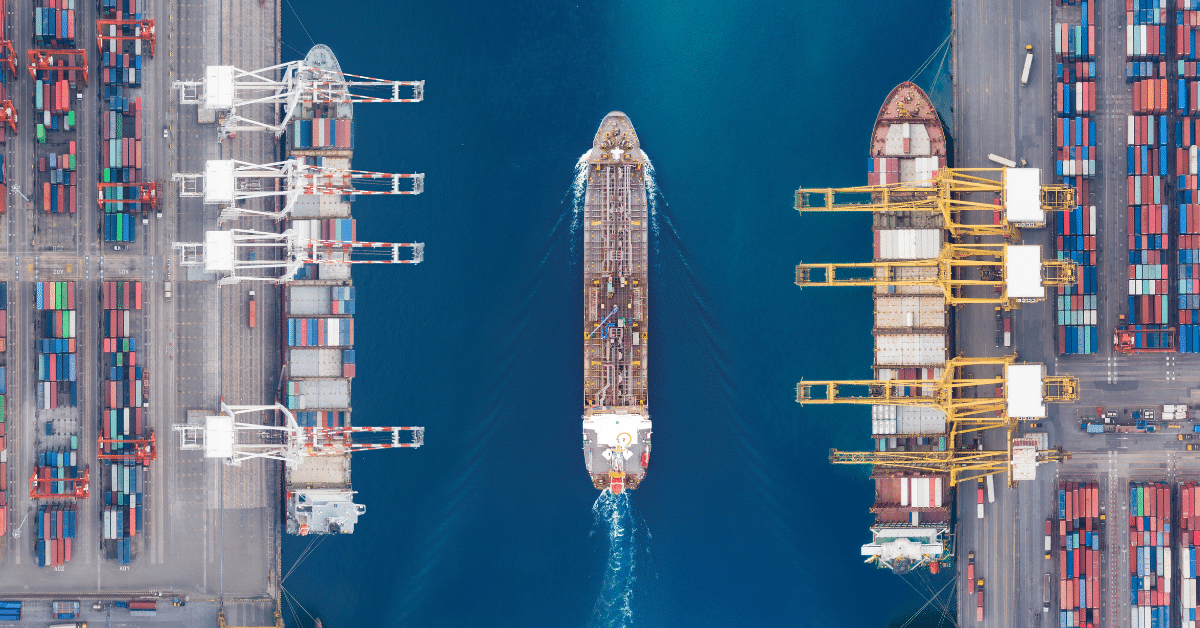

Closer to home, international trade is not quickly returning to pre-covid levels or pricing. Just as forward transactions in currency markets may secure future prices, so contracts in shipping were agreed months ago at a time where exporters could negotiate prices with the luxury of excess capacity.

How different it all seems today.

Rates to move goods cross-border have never been higher, as contraction of supply chains has caused every player in the ecosystem of trade to review capacity. Starting with transport companies, prices are expected to double (not helped in the UK by additional demands for costly ow emission or electric vehicles, highest ever diesel prices at pumps and congestion charges).

The freight sector, handling the physical movement of goods is also impacted in areas of warehouse costs, displaced containers, ocean shipping and local logistics. And companies are still subject to market demand and the influence of a rapidly changing spot market on a short-term basis. One example is the Brent crude oil price, at USD 55 per barrel one year ago is now standing at approx. USD 90, with predictions of USD150 within three months.

In addition to containers being in the wrong place at the wrong time, with less overall capacity, we have already witnessed the staggering increase in spot prices for standard 40-foot containers, with prices up to 5 times higher than pre-pandemic levels and set to move higher still. In some instances the cost of container transport even surpass the value of goods they contain, making it uneconomic and therefore impossible for smaller traders and niche businesses to sustain a healthy trade and cash flow.

Looking at the other areas of logistics in the supply chain, the cost of warehousing, increase in demurrage fees (namely the charge that the merchant pays for the use of the container within the terminal beyond the free time period), labour costs, increased fuel costs and shortage of drivers to move goods will lead to inevitable price rises.

With such uncertainty and taking into account the rising costs (up 25% on average for leasing warehouse space, it is no surprise that companies are not prepared to lock in long term leases, and taking the financial hit on shorter terms.

Whilst in the past the demand for goods at low price has meant shippers absorbing costs, the time has come where increases have become so common and of such magnitude that these costs must be passed on to consumers. Even using Ai technology for innovating least cost routing, consolidating shipments, sharing containers and only renting delivery vehicles when required, the choice is stark.

Inflation is on the rise and consumers must ultimately pay more as shippers and other players in the global supply chain find themselves with drastically reduced margins, operating expenses and more pressure than ever to deliver at a price the consumer can afford.

At the time of writing, with the UK Covid wine and cake Partygate debacle seriously overshadowed by ongoing international tension as Russia amasses on Ukraine’s border, fears abound of its longer term intentions to extend its reach to re-establish a power bloc similar to the former multi state Soviet Union.

Whether a show of force or build up to full warfare, the West will need to be mindful and fully prepared to deal with trade implications, sanctions, repercussions in the event of invasion, NATO and European military support, calls for removal of banks from the SWIFT network, and possible nation state cyber-attacks on all manner of businesses across the supply chain.

With such a fluid situation, whilst free trade agreements were supposed to bring unity, collaboration and increase in collective wealth, their purpose is clearly being eroded as former allies become enemies, and protectionism, nationalism and isolationism become the new order.

We hope for the best outcome and plan for the worst. The next quarter will be critical.

By Dr. Graham Bright

Head – Compliance and Operations

Euro Exim Bank

DISCLAIMER: Brand Voice is a paid program. Articles appearing in this section have been commercially supported.