4G Capital’s Chief of Staff, Genevieve Hennessy-Barrett discusses how inclusion, female mentorship and shared knowledge can cross borders and heal Africa’s displaced and most vulnerable women.

Access to financial services and the freedom to open a bank account remains unattainable for many women around the world, and even more so in frontier markets.

Some progress has been made; the number of bank accounts owned by women now equals men in South Africa. But, elsewhere on our continent, the situation is not so encouraging. According to a 2017 Global Findex report, the gender gap remains, on average, just over 9% across Sub-Saharan Africa, unchanged since 2011.

We are all too familiar with the numerous reasons why women all over the world find it difficult to gain financial independence. In ‘emerging’ markets there exists an even greater lack of opportunity in terms of education and work, and in some cases a cultural expectation that can prevent women from investing in their own future.

But no matter the challenge, women have always adapted and overcome through the creation of their own opportunities, and have worked together to protect and support their families and communities.

Female entrepreneurs make significant contributions to local and national economies. The SME Finance Forum’s research indicates that almost one third of the world’s small businesses are owned by women and account for 32% of the micro, small and medium enterprises (MSME) finance gap, estimated to be worth be $5.2 trillion.

Lack of collateral, official identification and correct paperwork, are the primary reasons for financial exclusion. Access to credit is often extremely difficult for MSMEs, and even more so for small businesses owned by women who are often given less favourable terms than their male peers.

As a fintech credit company working with MSMEs who are typically excluded from traditional financial institutions, 4G Capital has sought to bridge not only the finance gap, but also address the gap in financial literacy. By combining these offerings we can alleviate poverty sustainably and unlock vital human potential. We are on target to positively impact more than 1 million people by 2020.

We believe it is our blend of finance and education delivered via ‘touch-tech’ that is responsible for our appeal to many female business owners. Although we did not focus our marketing strategy on gender, 81% of our customers are female.

We are able to support their development through a bespoke programme of business training to help them use our micro-loans to achieve much higher take-home earnings.

According to recent research by one of our partners, Technoserve, this combination of training combined with working capital credit resulted in an 82% increase in revenue year-on-year.

But imagine the challenges faced by women who have had to flee their own countries, seeking refuge and safety for themselves and often for their children. Determined to build a sustainable future, their plight has gained the attention of RefuSHE, a charity set to provide support to refugee women in Kenya.

4G Capital has initiated a program to deliver business training and mentorship to RefuSHE’s Girls’ Empowerment Project (GEP), designed to give access to education and livelihood opportunities, while learning about human rights and cultivating leadership skills.

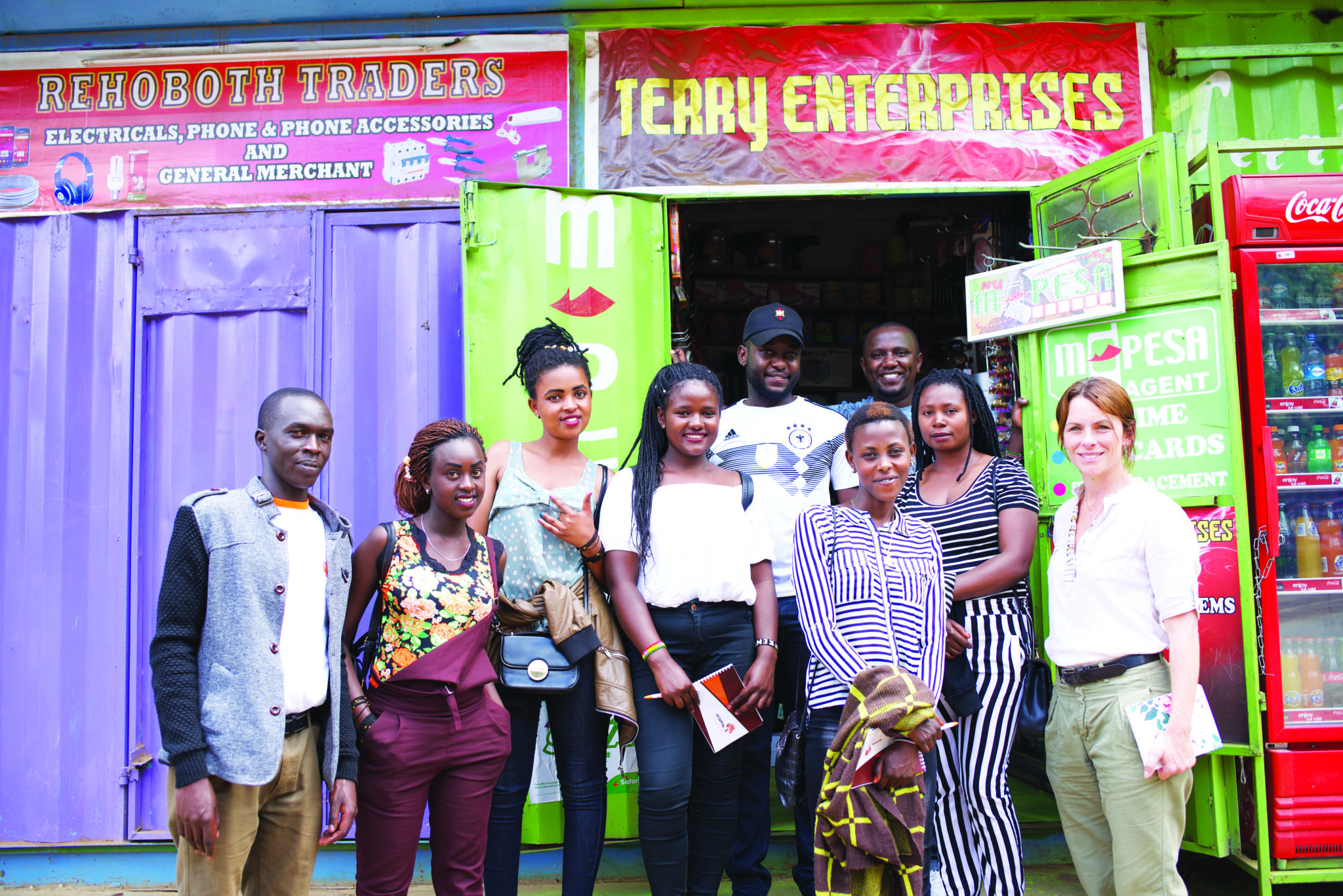

We kick started this partnership by welcoming the girls at one of our 4G Capital branches. They were given training on basic business principles such as book keeping and responsible management of business credit.

Based on what they learnt, RefuSHE’s girls have now taken part in our Business Plan Competition.

Successful participants have been taken forward to internships and matched with successful female entrepreneurs who are customers of 4G Capital.

They will be supported, mentored and trained. The hope is that with this initiative, these girls who were once so vulnerable will now gain the necessary skills to run a successful business, be part of a community and build a new life.

As we celebrate International Women’s Day, we’d like to honour all the women of Africa striving to build a future for themselves and their communities by saluting their determination, knowledge, wisdom, humour and humanity in the face of the challenges which affect us all.

DISCLAIMER: Brand Voice is a paid program. Articles appearing in this section have been commercially supported.