The SPAC boom—a money faucet for Wall Street, and a big potential hazard for retail investors—has minted another winner on the inside of a deal.

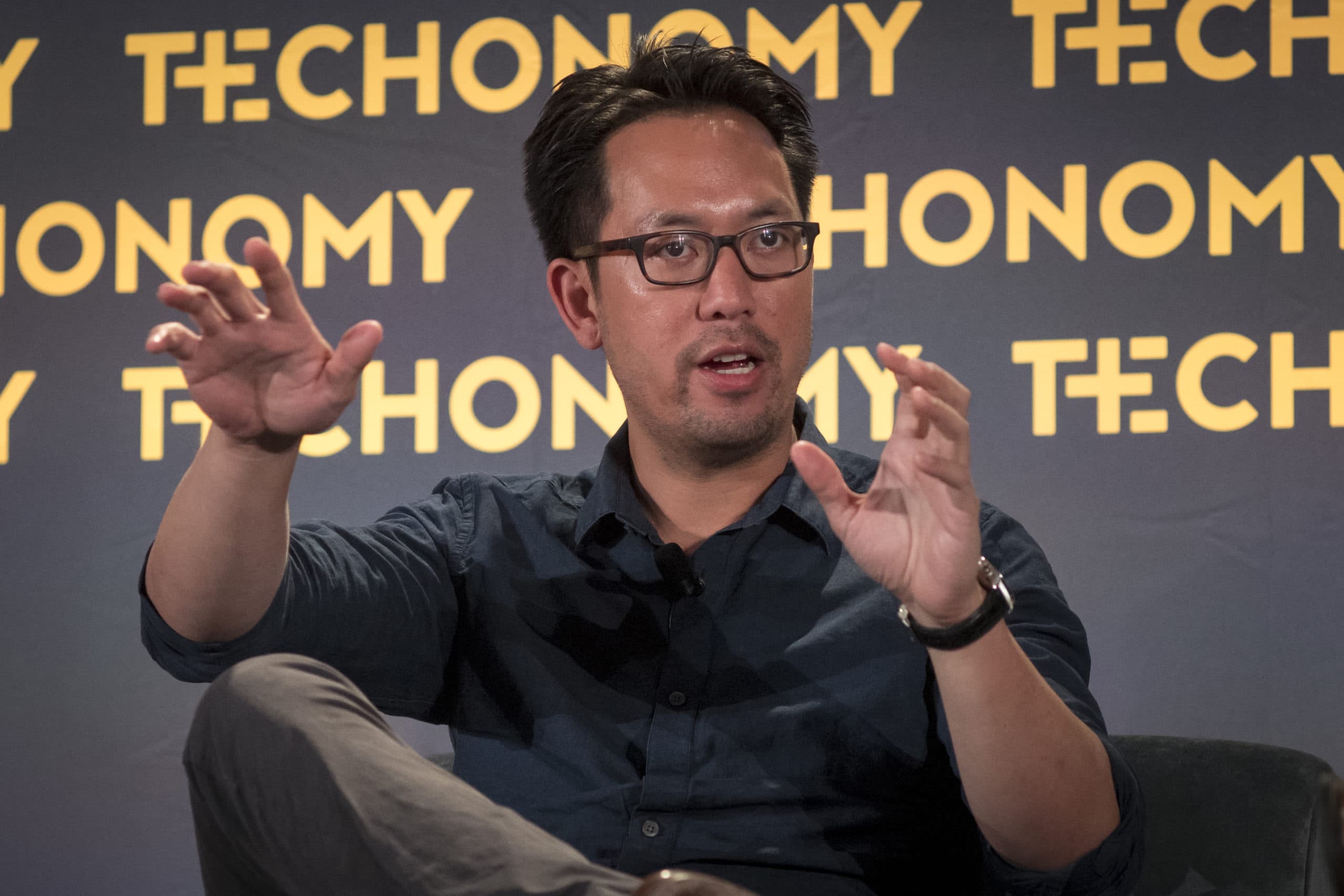

Eric Wu, cofounder and CEO of Opendoor, became a billionaire on Monday, the day the home-buying firm began trading through a merger with a SPAC called Social Capital Hedosophia Holdings II. At the close of markets, his 6% stake in the firm was worth $1.01 billion. It is unclear whether he will remain a billionaire at the end of after-hours trading.

Wu, 37, published a blog post on Monday morning celebrating the deal. “In 2014, a small group of us dreamt of a future where you could buy and sell a home at the tap of a button,” he wrote. “Like most startups, we’ve faced our fair share of hard problems, but we believed in the potential impact of what we were building and put in the hard work to tackle obstacle after obstacle.”

Through a spokesperson, Wu declined to comment for this article.

Opendoor is the leading business in the “iBuying” market, a relatively nascent industry that lets homeowners quickly offload their houses to the company, which then lists them on its platform. Opendoor uses algorithms to determine how much it pays—too little, and potential customers won’t want to sell; too high and the company could take a loss.

Last year, Opendoor sold nearly 19,000 homes, generating revenue of $4.7 billion, though it posted a net loss of $339 million. Sales dropped off dramatically this year, likely in part due to the pandemic. Through the end of September, revenue fell to $2.3 billion (more than $1 billion less than the same period in 2019), while losses amounted to $199 million.

Those losses, while trending in the right direction, have raised questions about Opendoor’s long-term path to profitability. The company, for its part, says it’s willing to lose money in the near future as it battles for market share. “Five years ago, we were in like two markets, three markets,” cofounder Ian Wong told Forbes this fall. “Today we’re in 21.”

iBuying remains a wide open field, even as Opendoor competes with Zillow, Redfin, Offerpad and other startups. According to The Real Deal, the industry still comprises just 0.5% of the $1.6 trillion home-buying market.

Investors clearly aren’t spooked. When Opendoor’s public offering was first announced in September, the company had an enterprise value of $4.8 billion. By Monday morning, its market value stood at nearly $18 billion.

Opendoor joins other newly public tech firms with soaring stock prices, including Airbnb, DoorDash, and Snowflake. Will those gains last? Time will tell, but the valuations sure look lofty.

By Noah Kirsch, Forbes Staff