A small percentage of the world’s richest people have publicly disclosed financial gifts to help fight COVID-19. Others are using their money to help support their own companies.

As the coronavirus pandemic sweeps across the globe, billionaires are donating to the fight against it—with some giving more than others. Since mid-March, Forbes has been tracking how much this ultra-rich set has been donating to COVID-19 causes. While most of the world’s 2,095 billionaires have yet to give, or won’t disclose how much they’ve spent, at least 77 of them have reached into their wallets. Of those, 54 have disclosed at least part of their giving while another 23, such as Alibaba’s Joseph Tsai, gave unspecified amounts of cash or provided assistance in the form of medical supplies or equipment that Forbes was unable to value.

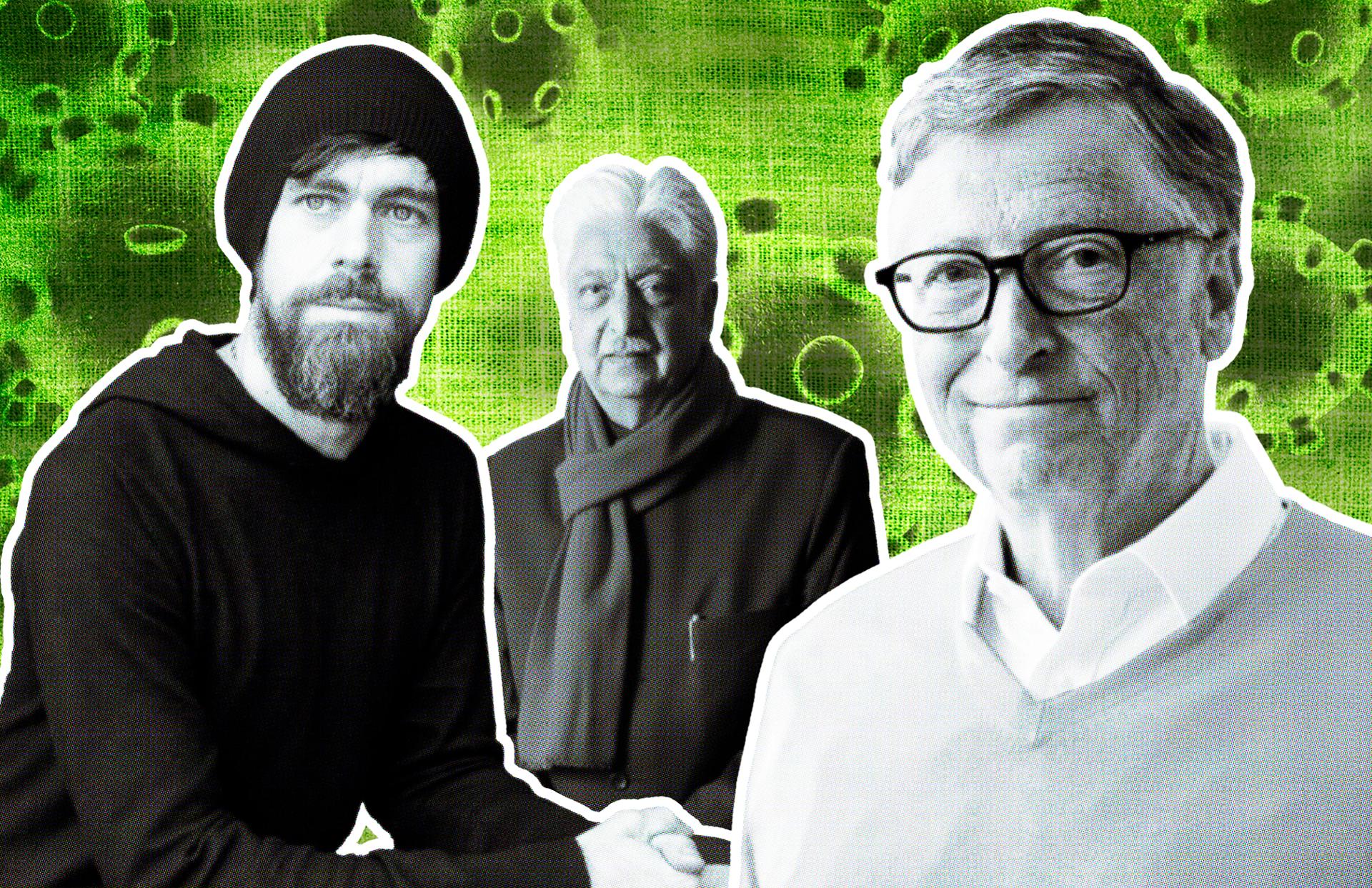

Of these billionaires, Jack Dorsey has emerged as the most generous giver so far, after announcing on April 7 that he was moving $1 billion of his Square stock—about a quarter of his $3.9 billion net worth—into an LLC to support COVID-19 relief efforts and other causes. It’s unclear how much of this $1 billion will go toward the coronavirus pandemic (so far he has given out about $5 million combined to four organizations), but even if it ends up being just 20% of his pledge, he will still have far outspent his peers. The second-largest pledge comes from Bill Gates and his wife Melinda, whose foundation has committed $255 million, much of it to be spent on vaccines, treatment and diagnostic development. Indian tech magnate Azim Premji comes in third, planning to give $132 million to humanitarian aid and health interventions to curb the spread of COVID-19.

Donald Trump, America’s first billionaire president, also makes Forbes’ roundup, following a $100,000 donation—one quarter of his salary—to the Department of Health and Human Services. The check represents 0.005% of his $2.1 billion net worth.

One Oklahoma billionaire who has committed $10 million so far was critical of President Trump, not because of his paltry gift but because of his administration’s response thus far. “It’s unfortunate that private charity has to assume the role of primary safety net and even supply chain and logistics manager because of the failure of government to perform its function,” said George Kaiser.

Here are the billionaires who disclosed gifts, sorted by contribution amount and then measured by gift as percentage of their net worth. (It does not include the 30-plus billionaires, including Ralph Lauren and Mukesh Ambani, whose companies have given aid or who have promised to use personal funds to help their companies weather the storm.)

Billionaire Contributions To Pandemic Relief

Some of the figures above are pledges. Net worth and giving data was last updated April 27, 2020.

Table: Forbes Get the dataCreated with Datawrapper

–Hayley C. Cuccinello, Forbes Staff, Billionaires